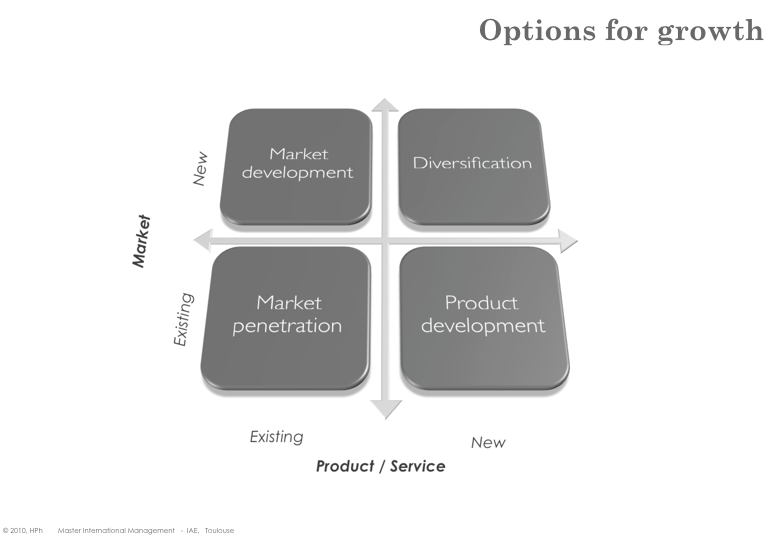

Options for Growth

The Ansoff’s Matrix

The famous Ansoff’s matrix was first published in 1957 in the Harvard Business Review. It portrays the four alternative growth strategies, by considering existing products vs. new products, and existing markets vs. new markets.

Market penetration consists in increasing the business through offering the same product/service to the same market. Market development and Product development are sometimes called related diversification (or adjacent diversification). The idea here is to either offer new products to existing customers or to propose existing products to new markets. Product development is the most challenging option.

Market Penetration

With Market Penetration, the firm seeks to achieve growth with existing products / services in their current market segments, aiming to increase its market share. It is the least risky strategy since it leverages many of the firm’s existing resources and it requires no change in strategic capabilities

In a growing market, simply maintaining market share will result in growth, and there may exist opportunities to increase market share if competitors reach capacity limits. Usually more business volume translates into some cost efficiency. However, market penetration has limits, and once the market approaches saturation another strategy must be pursued if the firm is to continue to grow.

There are two major downsides to Market Penetration:

Retaliation from competitors rivalry among competitors is likely to get exacerbated, especially in mature markets. Market penetration in low- growth markets often triggers horizontal integration and consolidation (one of the player seeks to acquire its competitors).

Legal constraints Anti trust regulations aims at limiting market power. Therefore authorities are likely to prevent consolidation beyond a certain limit.

Note: Retrenchment (a firm deciding to withdraw from a less attractive market) is the opposite to market penetration.

Product Development

With Product Development the firm develops new products and/or services – i.e. with different technologies – targeted to its existing market segments.

A product development strategy may be appropriate if the firm’s strengths are related to its specific customers rather than to the specific product itself (i.e. customer bonding, customer relationship, available customer data, …). In this situation, the company can leverage its strengths by developing a new product /service targeted to its existing customers.

Depending on the degree of relatedness, Product Development may imply acquiring/developing new strategic capabilities (e.g. new processes, new technologies, new know how, etc). Therefore it usually carries more risk (e.g. delays, cost overruns, failure) than simply attempting to increase market share.

Market development

With Market Development the firm seeks growth by targeting its existing products to new market segments.

Market development options include the pursuit of additional market segments (e.g. addressing additional user needs) or geographical regions (including internationalization).

The development of new markets for the product may be a good strategy if the firm’s core competencies are related more to the specific product than to its experience with a specific market segment. Because the firm is expanding into a new market, a market development strategy typically has more risk than a market penetration strategy.

Diversification

With Diversification the firm grows by diversifying into new businesses by developing new products for new markets.

Diversification is the most risky of the four growth strategies since it requires both product and market development and may be outside the core competencies of the firm. However, diversification may be a reasonable choice if the high risk is compensated by the chance of a high rate of return.

Other advantages of diversification include the potential to gain a foothold in an attractive industry and the reduction of overall business portfolio risk.

Diversification can occur at business level (expanding to new segments of the industry) or at corporate level (entering new businesses out of the scope of current activities). Differentiating diversification from market development or product development can be however rather subjective, as it depends on the way “new product” and “new market” are interpreted.

It is usually considered that there is diversification when and if a firms tries to develop a new strategic segment, which usually requires new capabilities. Although diversification can be accessible through pure organic growth (developing existing resources & competence), it is often associated with external growth and, in that case usually requires Mergers & Acquisitions and/or Alliances.