Growth Pathway

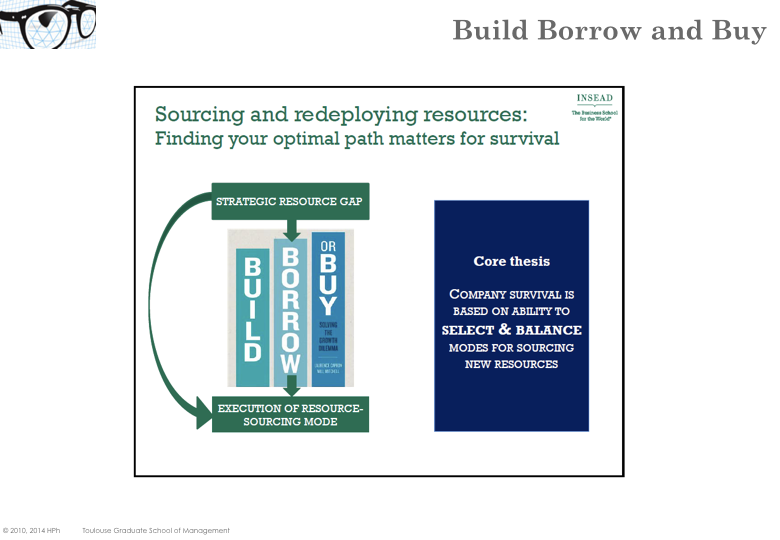

Buy Borrow Build

M&A are sometimes launched without any sound rationale. This is often viewed as ’the one way’ whereas a more flexible approach (alliance, commercial relationship) would bear more promices. „CEOs suffer from blind spots about alternatives ways of undertaking important changes - Mergers and acquisitions often create more headline than value” (L. Capron).

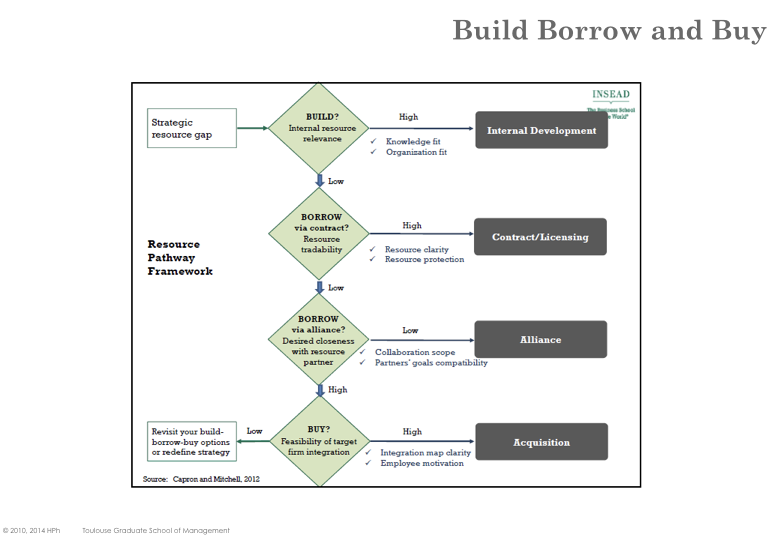

Laurence Capron has designed this framework to guide companies and help them select the appropriated growth option. Indeed she stresses that many firms expect acquisitions to accelerate their growth, but executives often turn to them for wrong reasons:

Self-interest M&A feed managers’ egos, reputations and empire building aspiration. Planning a large acquisition may also mask the poor performance of their current portfolio. Managers often abuse M&A because of incentive systems and short term focus on earning per share over long- term value creation.

Over commitment M&A is often the preferred mode of growth regardless of the context. In addition, managers tend to focus on a particular target that first triggers their interest, even before performing a comprehensive analysis. A good approach to weight the early enthusiasm is to establish red and green teams, in charge of building the positive and negative case respectively. Staff members should take turns serving on red teams so that no one become type-cast.

Blocking strategy use acquisition to stop competition from purchasing a target, according to the famous if we don’t do it someone else will. The buyer always incurs the costs of acquiring and integrating the target (and M&A always bring unanticipated roadblocks and expenses). Competitors can nearly always find alternatives.

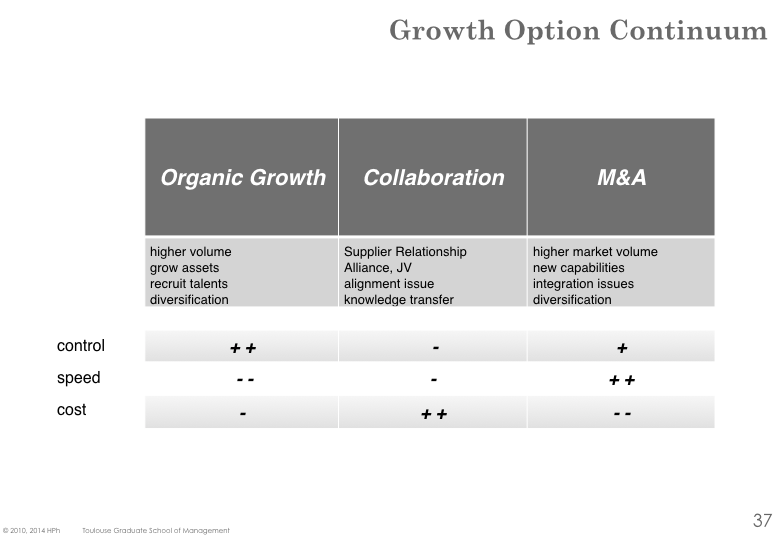

A continuum of Growth options

In real life the distinction between the three options are not as sharp as it may seem. In addition, depending from the perspective (i.e. legal ) moves may be interpreted differently.

Strategic alliances

The term Strategic Alliance corresponds to a broad concept that encompasses: a variety of situations where two or more companies set a formal or informal agreement to pursue a join & shared objective.

An alliance is a form of collaboration where each partner contribute strategic capabilities (assets, knowledge, reputation) to a project.

An alliance can be established through

non-equity alliance partners remain independent legal entities. A contract defines the roles and responsibilities of the parties toward a join objective.

equity ownership partners own stakes in each other (e.g. Renault owns 43,4% of Nissan and Nissan owns 15% of Renault). In addition partners will have representatives to each other board of directors. Not all cross shareholding correspond to equity alliances. Indeed an alliance requires the will to collaborate to a join project.

joint venture a new independent company is established and co-owned by the partners.JV are both a form of collaboration and a form of M&A. Sometimes, JV are not considered strategic alliances as resources are pooled in a separate new legal entity

Strategic alliances can be characterized according to whether or not partners operate in the same industry:

horizontal strategic alliance are formed by companies active in the same business area (e.g. Nissan Renault, Airline alliance)

vertical alliance collaboration between upstream and downstream players in the same value chain.

intersectional alliance partners are operating in different markets and control very different resources and competences. They were not connected by a vertical chain or worked in the same business area.

Likewise strategic alliance can be characterized according to the nature of the strategic objective that triggers collaboration:

Coalition based alliances partners –usually from the same industry – seek to achieve global presence, improve their market position and increase their market power compared to other competitors.

Co-specialization alliances partners combine their complementary expertise to develop and market new product / services.

Learning alliances partners join forces to develop new technologies or solve technical issues.

By and large, collaborations cover one or more of the following purposes:

Technology development improve technology or develop know-how.

Operations & Logistics build economies of scope / scale.

Marketing & Sales distribution infrastructure, affiliate marketing, franchise, licensing.

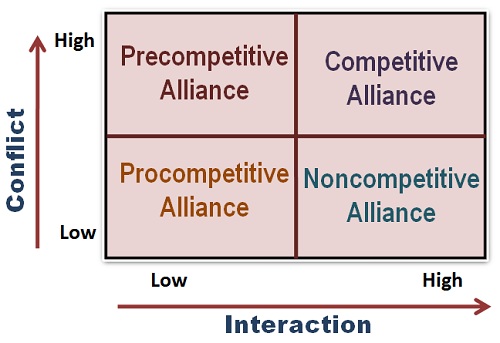

Yoshino and Rangan ( [Yoshin95] ) consider that strategic alliances are significantly influenced by the Extent of organizational interaction (how much must the partners interact to have the alliance work effectively) and conflict potential among the alliance partners (particularly if partners are also competitors in the market).

Four situations may arise:

Pro-competitive Alliances corresponds to low interaction and low conflict. It typically reflects a relationship between a manufacturer and its sup- pliers or distributors.

Non competitive Alliances are characterized by high interaction and low conflict. They are formed between the companies that but do not consider each other as rivals (even if they operate in the same industry) for the purpose of the alliance. Geographical expansions often rely upon such alliances.

Competitive Alliances are characterized by high interaction and high conflict. Partners perceive each other as rivals. Technology development, market access or offsets are typical reasons for establishing such alliances

Pre-competitive Alliance corresponds to a situation with low interaction and high conflict. Typically it can be a partnership between firms from different, unrelated industries who join forces towards the development of a new product or technology.

Acquisitions

M&A becomes the right pathway when i) the firm has identified and made explicit the strategic rationale for the move and ii) all alternatives options have been ruled out (e.g. the firm lacks the internal skills and resources to build in- house and as no effective contractual relationship can be established with a partner then a full control over the partner is required).

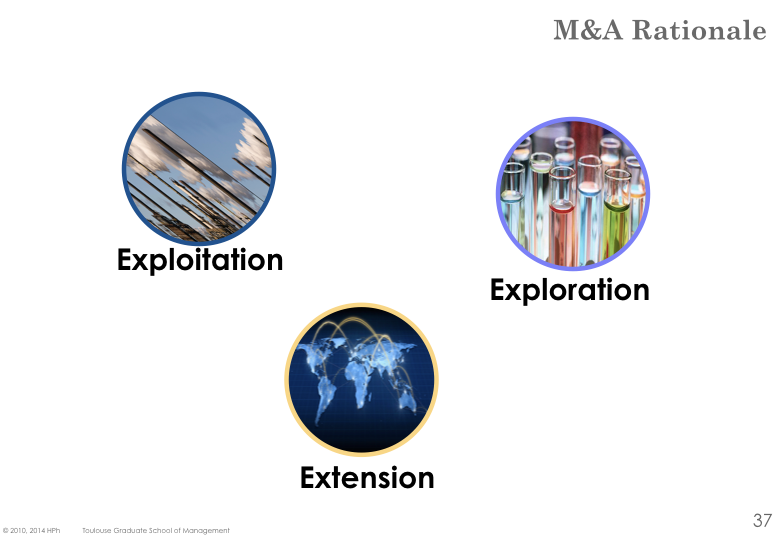

There are three main ’flavors’ of resource combinations that can be brought by M&A:

Exploitation the acquired company brings resources that complement and strengthen the core domain of the firm, which enhance its existing activities in its established markets

Extension the acquired company facilitates the development into new markets (geographic, new customer groups, etc) or provides additional products / services that can be offered to existing customers.

Exploration the acquired company allows exploring new market-spaces, potentially through disruptive technologies, products or business models. When carefully chosen, priced and executed, M&A help firms create value by providing access to new technologies, exploiting learning opportunities, meeting customers’ needs, exploiting economies of scale or restructuring industry capacity.