Value Equation

Before borrowing money from a friend,

decide which you need more.

Addison Hallock

One may argue that preparing business cases doesn’t strictly fall within the scope of strategy, and even less of corporate strategy. There are however at least three reasons for looking at business cases as part of strategy elaboration:

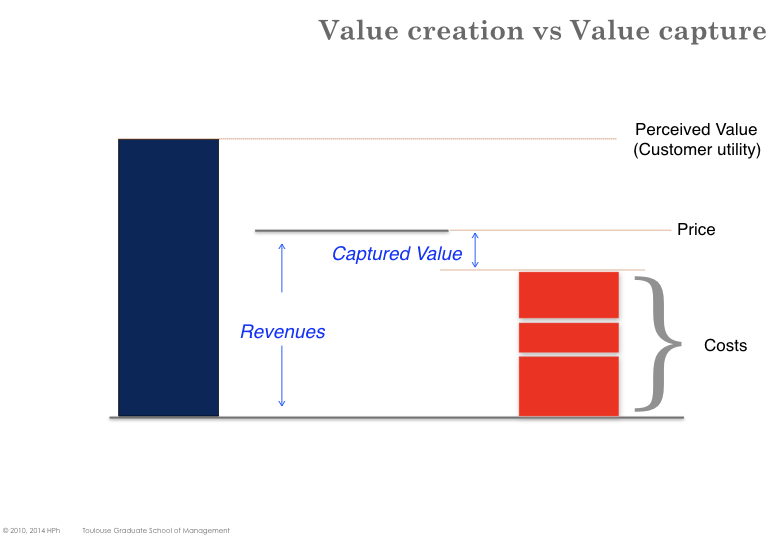

Value: strategic moves are about generating value. Although value must here be understood in its widest sense, many stakeholders (starting with shareholders) will measure value in terms of the financial impact.

Investment: strategic moves will also require mobilizing and/or acquiring resources. Financial resources and investments will be under the scrutiny of the Chief Financial Officer, and it is very unlikely that any significant investment can be allowed without a sound financial justification.

ACID Test: the most common excuse for people who fail to elaborate a business case is it is strategic (meaning it is so important that is doesn’t even need to be justified). Likewise it is not uncommon to discover that a supposedly competitive advantage turns out to be undetectable when translated into figures.

In strategy, the objective of ”a business case” is to substantiate the qualitative orientations with quantitative forecasts. Figures (usually orders of magnitudes) can then get connected and compared with business-as-usual operations. This chapter briefly presents how to put together a financial business case and introduces some key concepts of Corporate Finance.