Management Accounting

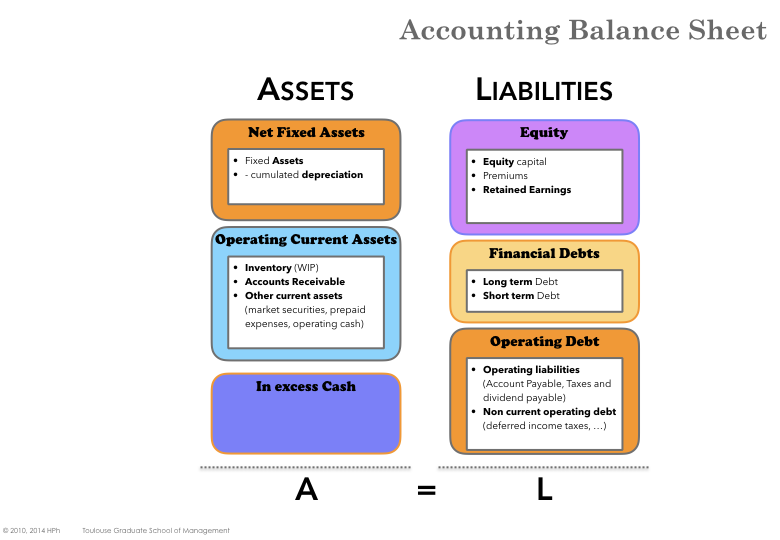

Accounting Balance Sheet

The balance sheet identifies at a specific date the company’s assets – i.e. the uses of funds, what the company owns (equipment, cash, inventories, money due from customers) – and claims to those assets by creditors and owners – i.e. the sources of funds – what a company owes to its shareholders, its banks and its suppliers (debt holders).

On its left side, a balance sheet lists the company’s assets (i.e. the uses of the funds, what the company owns : equipment, cash, inventories, money due from customers). On the right side, the balance sheet lists the claims to those assets by the owners and creditors (i.e. the sources of funds, what the company owe to its shareholders, debt holders and suppliers).

Equity and Liabilities

Equity represents the contribution by owners to a business, along with any profits that are kept in the business. The contribution provides resources to the company and represents a claim by the owner to profits earned by the business. It consists in:

Capital (at book value) existing share times nominal value.

Premiums when issuing additional capital, investors will have to pay a premium to be allowed to join the business. The actual price of such shares is premium + nominal value.

Retain earnings the accumulated profits that have been re-invested in the business, yearly incremented (or decremented) by the net profit minus the dividends paid to shareholders

Financial debt Borrowing is another source of money for a company, let at the company’s disposal by financial actors – for a limited period of time – to help the corporation finance its operations. Creditors (lenders) have a claim for repayment of amounts the company borrowed (the principal of the loan) and for interests on amounts borrowed. Two types of debts are considered, according to their maturity: Long-term debt (supposed to be repaid in more than one year) and Short-term debt (will be repaid within next year which creates a liquidity risk and pressure on cash position). Short Term debts include notes payable, bank overdrafts, lines of credit. The portion of any long term debt due within a year is also considered a short term obligation.

Operating current liabilities by contrast; corresponds to liabilities generated by the business operations and covering several items : Taxes & social security expenses (that the company must pay but hasn’t paid yet), Accounts payable, Dividend payable, Accrued expenses.

Account Payable are liabilities to the suppliers of the company. it arises because the company doesn’t pay immediately the products and services it uses. There is a time lag between the receipt of goods and payment for them.

Accrued Expenses are liabilities associated to the company’s operations (other than short debt debt and account payable). It includes for instance, wage and taxes that are due but have not been paid on the date of the balance sheet.

Assets

Fixed assets equipment (machine, pieces of software, technology) purchased to allow the organization to reach its strategic goals and not renewed at the rate of the operating cycle. As some of the long-term assets are ’consumed’ by the operating cycle, they depreciate and therefore the net asset value correspond to the initial value minus the cumulated depreciation and/or amortization over the years. Broadly speaking, there are three categories of assets : Tangibles (physical as- sets), Intangibles (software, patents, trade-marks, goodwill) and Financial (e.g. equity invested in non-integrated subsidiaries). Tangible assets are deprecated and Intangible assets are amortized over time.

Operating Current Assets are those short-term as- sets used to support the operations of a business. In most organizations, the key operating current assets accounts receivable and all forms of inventory (work in progress at various stages).

Account Receivable record the invoices that have not been paid yet by customers at the date of the balance sheet. Accounts Receivable are debts ow- ned to the company by its customers. When customers pay their bills, this asset will be converted into cash.

Pre-paid Expenses correspond to payments already made by the company although the corresponding products or services will be received after (or extend beyond) the date of the balance sheet. For instance, the payment of an insurance policy is usually due in advance and therefore is recorded as pre-paid expenses.

Inventory are goods (raw materials, finished and semi-finished products) held by the company for future delivery. A manufacturing company has normally three inventory lines in its balanced sheet : raw material, work in progress and finished good.

Cash & Cash Equivalent

encompasses cash in hand, deposit with banks and short-term investments (marketable securities) with maturity not exceeding on year.

Sometimes, Cash is subtracted from financial debts which gives the net financial debts.

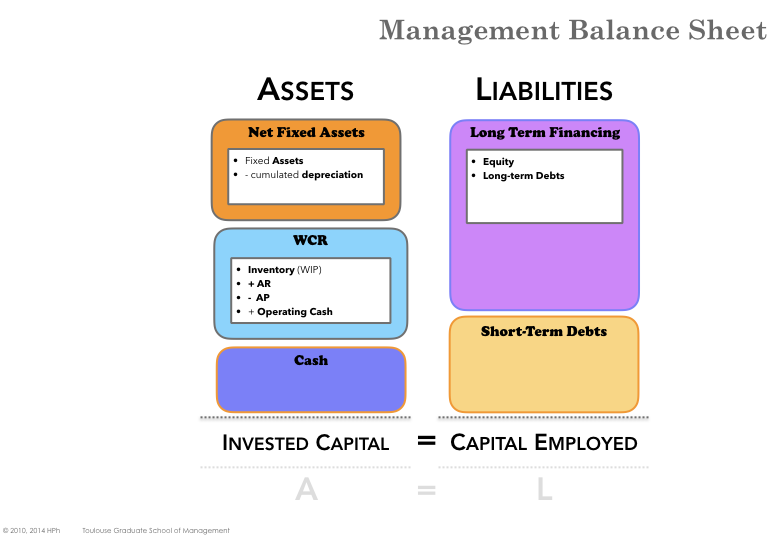

Management Balance sheet

The so-called Management Balance Sheet is obtained from the Accounting Balance sheet through moving items (mostly operating debts) from left to right or vice versa (by subtracting the same amount on both side).

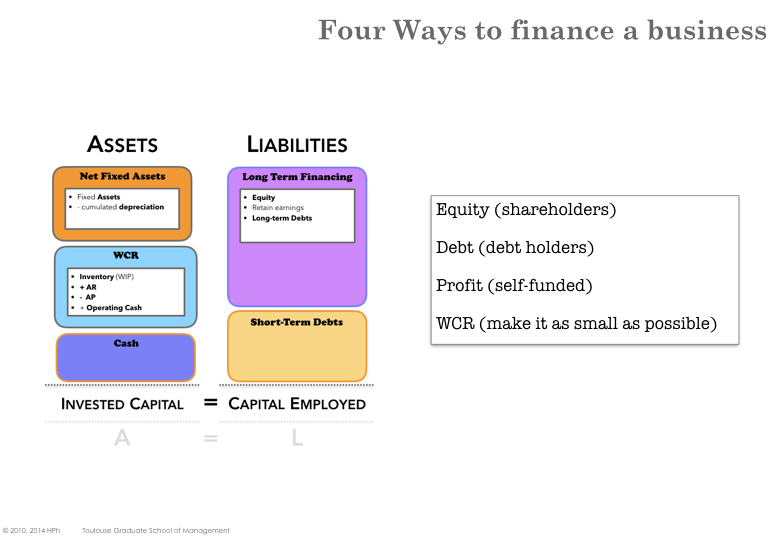

Ways to finance the business

For any business there are four main sources of financing:

Equity financing can be brought by shareholders either when the firm is incorporated or later during its development.

Debt firms can borrow money from banks or if its size is sufficient directly from the market (e.g. through bond emission).

Profit If a firm makes profit, it can retain its earnings and self fund its development

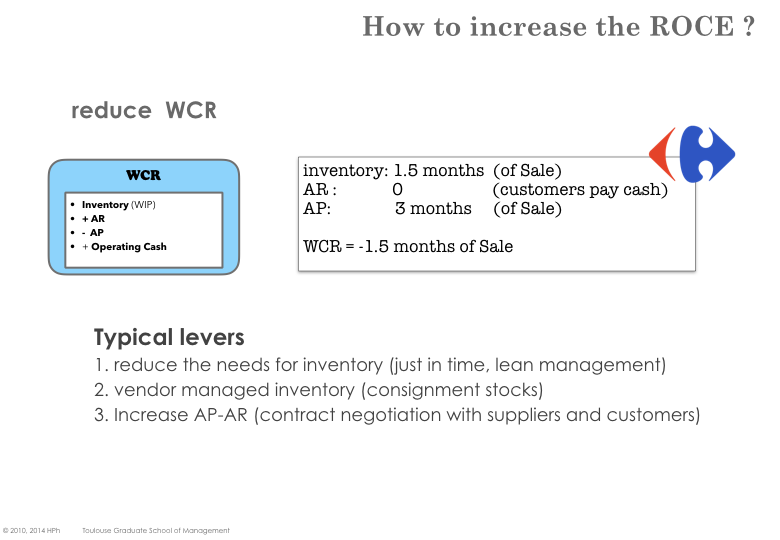

WCR Reduction decreasing WCR reduces the need for further financing. In addition, if WCR becomes negative (e.g. Account Payable > Ac- count Receivable) then it becomes a true source of financing (e.g. supplier are lending money for free).