How much is a firm worth ?

There are several popular valuation methods to assess the value of a project (including the acquisition of a company).

Valuation by comparable looks for similar firms, or firms specialised into the same business (proxy) and infer a price by comparison.

Discounted cash-flow (DCF) present value of the stream of cash flows.

Liquidation value amount of cash that the firm would receive if it would sell separately its various assets (trade receivable, inventories, equipment, land, buildings, etc). It is the minimum price you would have to pay for the firm’s assets

Replacement value what it would cost today to replace the various firm’s assets. This is the maximum price you would accept to pay for the tangible assets. However, you may accept to pay more for some intangible assets controlled by the firm.

Free Cash Flow

The Free Cash Flow is a ’flow’ (i.e. computed over a period of time) that corresponds to the cash that the firm can allocate to the Capital owners (Equity or Debt holders). The net cash position is a ’stock’. The difference between the net cash position at two dates, is the free cash flow over the corresponding period.

Computing the Free Cash Flow of a project

There are several ways to compute the Free Cash Flow associated with a project. Let’s start with assessing the effect of depreciation on taxes:

\[ EAT = EBIT − I − EBIT.T_r \] \[EBIT.T_r = (EBITDA − DA).T_r = EBITDA.T_r − DA.T_r \]

Thus, if a project requires some “capex”, it will later produce a flow of Depreciation & Amortisation (DA), which will reduce the total taxes in proportion.

The net cash inflows of a project consist therefore in:

Operations: \( EBIT DA ∗ (1 − T_r) \)

Impacts on taxes: \( DA ∗ T_r \)

The cash outflows are:

Incremental Capex (yearly): \( \Delta Capex \)

Incremental WRC (yearly) Working Capital Requirement: \( \Delta WCR \)

Discounted Cash Flow

One of the most important decisions a manager can make is the capital investment decision: spending cash now to acquire long-lived assets that will gene- rate cash flows in the future. Capital budgeting involves comparing the amount of cash spent today on an investment with the cash inflows in the future. As future cash inflows are spread over time, they must be converted into their equivalent today value.

Capital budgeting involves comparing the amount of cash spent today on an investment with the cash inflows in the future. As future cash inflows are spread over time, they must be converted into their equivalent today value. The present value is the discounted value of future cash flows (possibly including some risks associated with future payments).

Typical capital investment process: identify opportunities, estimate future cash flows and discount rate, assess the impact of tax treatment, select & implement.

Valuation through DCF

The (present) value of any company yields from the series of its future Free Cash Flows. Assuming that the future cash flows can be assessed, it becomes easy to assess the value of a company.

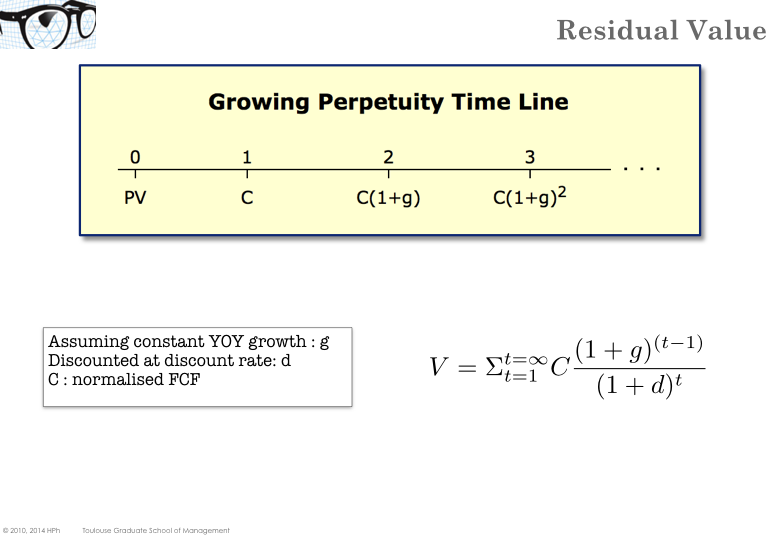

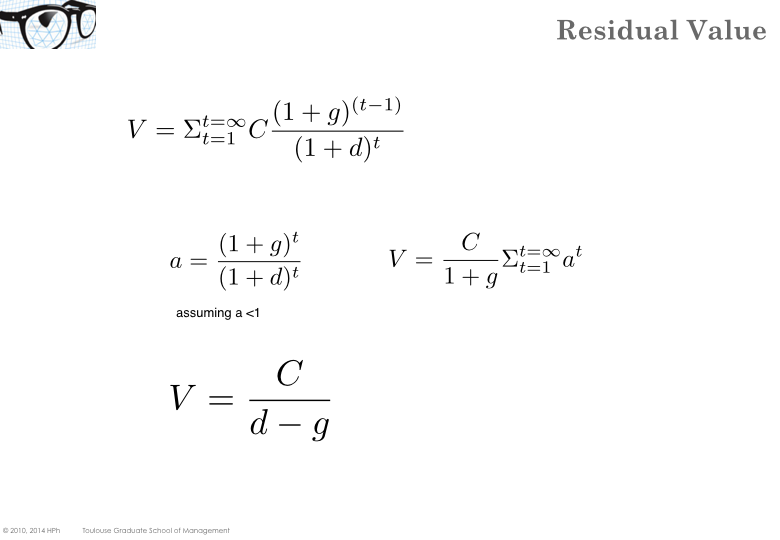

Infinite annuity

Let’s suppose that the FCF C increases over time at a constant rate g. On the first year, the FCF is \( C \), on the second it is \( C(1+g) \) and on the nth ii is \( C(1+G)^{n−1}\) . Let’s also assume that the discount rate d is constant. How much is the present value of this infinite series of annuities ?

DCF Value

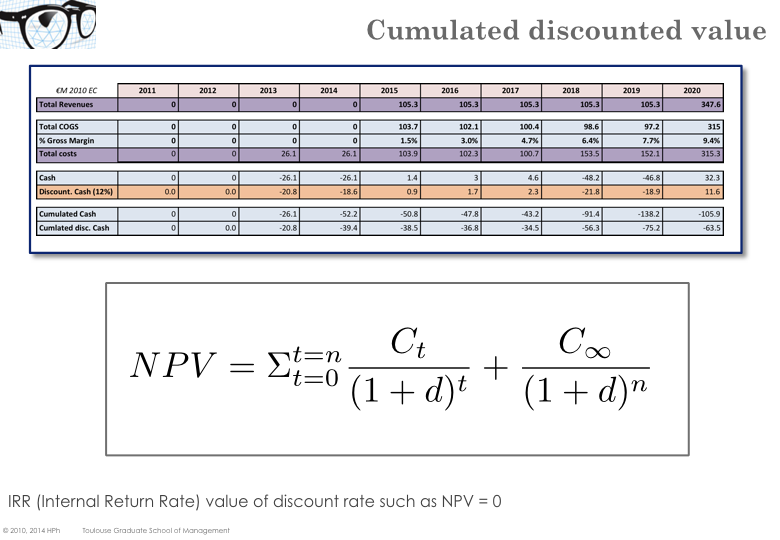

The total DFC is the sum of the present value of the n first years plus the present value of the terminal value (computed on year n).

Enterprise Value

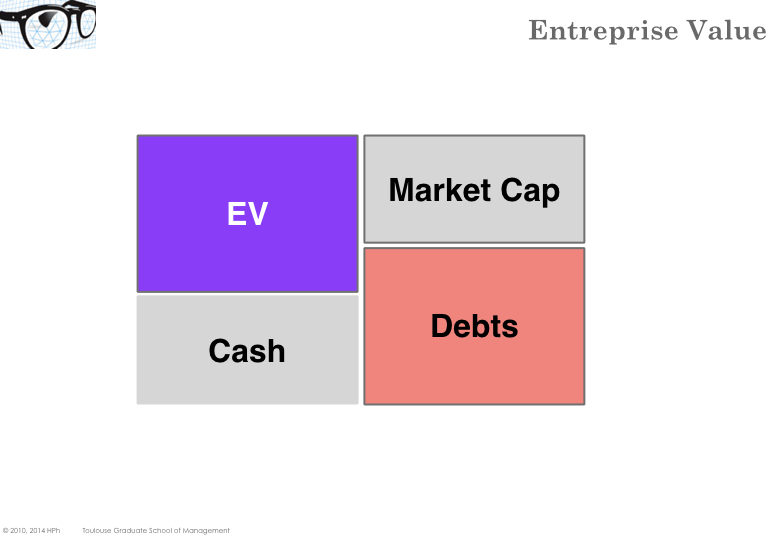

The enterprise value is an attempt to measure how much a business is worth. EV approximates a (theoretical) take over price. Actual transactions are usually not made at EV price, still it is common practice to provide EV for listed companies.

In theory, taking-over 100% of a company would require buying all the shares (at market value). With all the shares in hand, one would own the cash and the so called enterprise value, but would still have to repay the debts of the company

So Market Capitalization = EV + Cash − Debt. In other words EV = MarketCap + Debt − Cash.

Value Creation through M&A

In real life, when a company is acquired, the acquisition price the always higher than the listed price. The difference is called acquisition premium.

In addition to paying the former shareholders, the new owner needs to pay transaction costs (to bankers, consultants, etc…) and post merger integration costs (e.g. alignment of the management information systems, finance reporting, etc…).

It is also very common that during first months after an acquisition the customer base shrinks: some existing customers decide to switch to other suppliers.

To compensate for all these cost items, the new owner must create cost synergies (doing the same with less costs) and revenue synergies (e.g. cross-selling and leveraging a larger sale force). Value is created only if the sum of the synergies exceeds the sum of the costs