Competitive advantage

Performance difference is not the rule in all industries and sometimes although differences may exist, they are often short lived. Nevertheless some firms, in many different industries, in many different countries and contexts, are doing better than others. The concept of competitive advantage has taken center stage in business strategy.

As stressed by ‘W. Pietersen” « Competitive advantage is one of those buzz phrase that has become a substitute for thought » ( [Pietersen] )

The central research research question for strategic management is to understand “why do some firms persistently outperform others” [Barney07].

Practitioners, for their part, not only seek to understand the origins of outperformance but try also to find ways to maximize the performance of their organization. Indeed they are not interested in making predictions only, but also seek to make prescriptions.

Two dominant theories

Two major theories have been developed by scholars in strategic management, to explain and identify the conditions under which some organizations can create and sustain performance differentials.

The Market-Based Theory of the firm is mainly inspired from industrial economics. Porter ( [Porter85] [Porter98] ) is one of the most prominent figures of this theory. According to it, over performance ties in with market power and power negotiation. It arises from the structure of the market and is deeply rooted into positioning the firm in its product-market arena. The sustainability of the advantage depends from structural barriers (e.g. barriers to entry, barriers to exit).

By contrast, the Resource-Based Theory ( [Barney07] ) offers a wider spectrum of potential sources of over-performance. Distinctive, valuable firm-level capabilities built over time and that competitors are unable to reproduce, support the differential ability of firms. The advantage relies less on the industry structure and more on the specific abilities that a firm can mobilize to respond more effectively and efficiently to customers’ needs. Sustainability is associated with the cost that would incur less efficient firms to copy the most performant firms.

What is a competitive advantage?

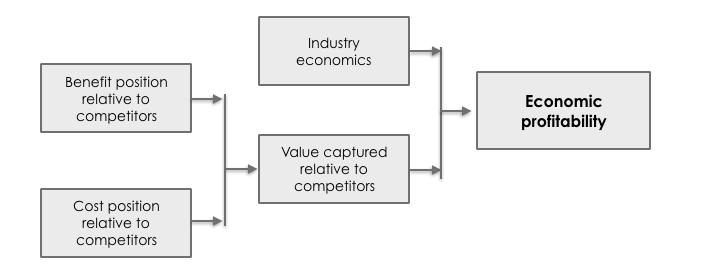

The two dominant theories (Market View Theory, Resource-Based Theory) put over-performance at the forefront of their research agenda.

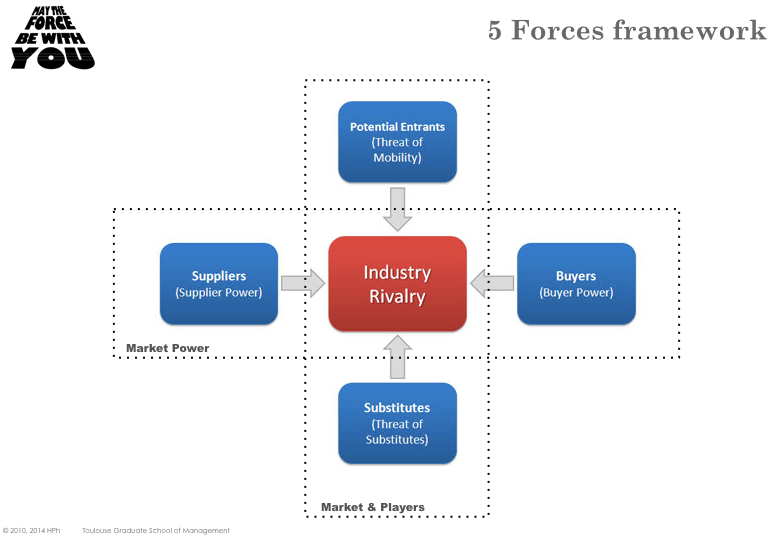

Barney ( [Barney91] ) underlines that the market-view of the firm focuses on competitive imperfections in product markets to explain persistent differences in firm performance. The 5-forces framework is for instance, one of the most prominent tools to underline such imperfection and identify opportunities to earn superior returns. However, whether a firm can gain a competitive advantage doesn’t depend solely on strategies that create competitive imperfections in product markets but as well on the total cost of implementing these strategies (which is determined by the competitiveness of the strategic factors).

„An enterprise has a competitive advantage if it is able to create more economic value than the marginal (break-even) competitor in its product market, where economic value is the difference between the perceived benefits gained by the purchasers of the firm’s goods or services and the economic cost to the enterprise.” [Peteraf03]

By contrast to the market-view of the firm, the RBT – Resource-Based Theory aka Resource-Based View of the firm – makes two assumptions in analyzing sources of competitive advantage. Firms within an industry (or a strategic group) may differ with respect to the strategic resources they control. In addition, these strategic resources may not be perfectly mobile among firms and therefore heterogeneity can be long lasting.

„An enterprise is said to have sustainable competitive advantage when i) it is capturing more economic value than the average firm in its industry and ii) other firms are unable to duplicate the benefits of this strategy.” [Barney, 1991]

A competitive position can usually not be considered sustainable or defensible for ever. Sooner or later, competitors will find ways to match the advantage.

As stressed in ( [Magreta11] ) to succeed a firm shall not seek to be the best but to become unique.

How to measure Value for the firm ?

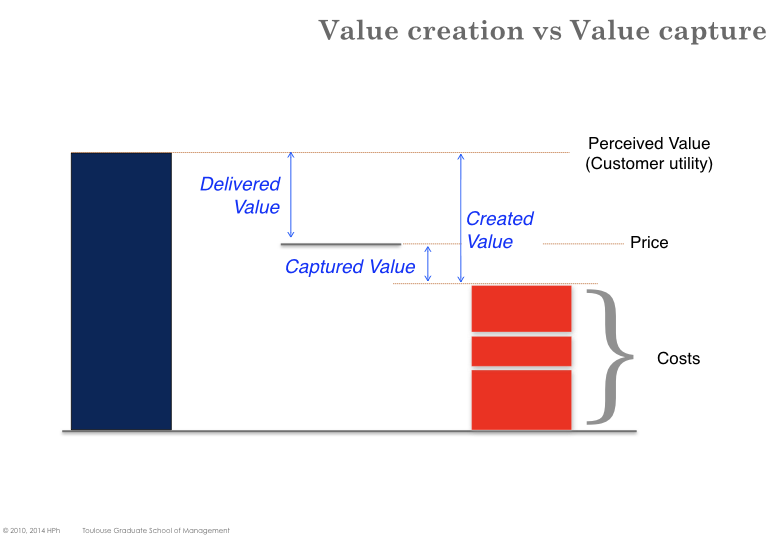

Value creation corresponds to the total perceived value net from the total expenses (including direct & indirect costs, Depreciation & Amortization) incurred to design, produce and deliver the product or service.

Some of this value is transferred to customers (Customer’s surplus) and some (the difference between the transaction price and the total cost of the good) is kept by the firm. Any firm must ensure that it both creates value at least for some customer groups and claims value so that it can generates some profit.

The total created value is (not necessarily equitably) shared between the delivered value transferred to customers as surplus and the captured value kept by the firm.

Most of the time a company has suppliers (i.e. it participates to a value system). Each of the players in a value system does not receive a remuneration only in proportion to the value it creates, but as well in proportion to its market power and the exercise of that power) in the sector.

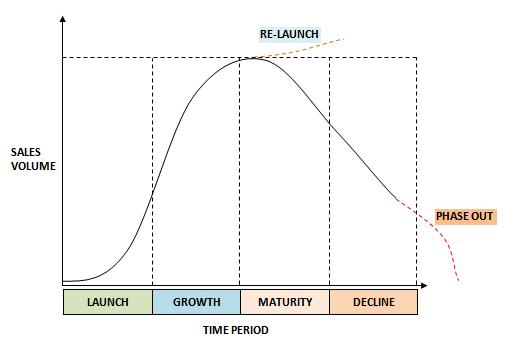

Industry Lifecycle

Any thorough analysis of an industry should take into account the stage of development of that industry.

At least four stages should be considered:

Launch (or initial development, or product introduction): the industry is still experimental in many ways. It usually consists of very few players with very differentiated products. There is little direct rivalry. Even if the industry doesn’t collapse, it is very likely that not all players will make it to the next stage.

High Growth rivalry remains low as the market offers high opportunities. If barriers to entry are low, new players will be attracted which will increase rivalry.

Shakeout demand approaches saturation levels. A significant portion of demand correspond to replacement because fewer first-time buyers remain. As firms have been accustomed to high growth they may continue to add capacity at a rate that become inconsistent with actual demand and translates into over capacity.

Maturity the market is totally saturated, demand limited to replacement and the growth rate declines. Rivalry is likely to increase as players can only gain new revenues at the expense of their competitors (zero-sum games) which impact prices. Some players will seek to exit the market which may drive more consolidation of the industry. Barriers to entry will usually increase (and as a result the threat to new entrant is vanishing). Firms that remain in the market will seek to drive their cost down and build strong brand loyalty. Periodic price wars may occur among surviving players

Decline growth become seriously negative and no more investments on products/services (substitution products are getting more traction). Players seek to harvest as much as they can before leaving the industry. The degree of rivalry usually decrease. However if exit barriers are high and the decline is quick, the industry is likely to suffer overcapacity (as in the shakeout phase) which can trigger fierce price wars.

| Stage | Launch | Growth | Shakeout | Decline |

|---|---|---|---|---|

| Nb players | Very Few | More | Many | Concentration |

| Product Diff. | Highly differentiated | Converging | Commodity | Commodity |

| Direct Rivalry | low | low | high | low |

| New entries | few | Many | None | Exit |

Economic Rent

To economists „A a rent is any payment to a factor of production (i.e. resource) in excess of its opportunity cost” [Krugman 16]

Three major types of rents can be identified:

Monopoly rent earned by a firm that enjoys a legally enforced or de facto monopoly (i.e. is the only firm to satisfy some customers’ requirements). The rent stems directly from the market power enjoyed by a monopolist, but is also contingent on demand elasticity, which depends on the availability of substitutes.

Ricardo rent earned by a firm that possesses valuable and rare factors (see below).

Schumpeterian rent earned by innovators during the (limited) time period between the introduction and large diffusion of an innovation.

Ricardo Rent

Ricardo rents are often considered as the tangible materialization of a competitive advantage.

„The Law of Rent states that the rent of a land site is equal to the economic advantage obtained by using the site in its most productive use, relative to the advantage obtained by using marginal (i.e., the best rent-free) land for the same purpose, given the same inputs of labor and capital” * (D. Ricardo, An Essay on the influence of a low price of corn on the profits of stock, 1809)

David Ricardo, a British economist, introduced the concept with an example borrowed from agriculture.

Let’s consider the business of growing wheat and assuming that ’land’ is the only significant factor of production. Back in the XIX century it was indeed the case as i) labor-cost was insignificant ii) there was very little capital investment in farming i.e. no agricultural machinery, duty trucks and iii) operating expenses such as fertilizers, pesticide, etc were inexistent.

At first, only the most most fertile parcels of land are under cultivation. At a certain point, all such land is used and population increase force into cultivation inferior lands: additional crops are seeded on less fertile parcels to meet the new demand. The cost to produce one unit of crop in inferior lands is superior to the cost of producing the same quantity in superior lands. On the market, however there will be only one price (that needs to be greater than or equal to the cost of production on inferior land). This counterintuitive result (raising the total quantity produced will cause the price to also raise) illustrates that the best lands (scarce resources) will benefit an extra return (the difference between the cost of production in superior and inferior lands).

Does operational excellence contribute to strategy?

In a famous article ( [Porter96] ) Porter insists that although Operational Excellence contributes to superior performance, it should not be confused with Strategy. In his views, both operational effectiveness and strategy are essential to superior performance but the two approaches work in completely different.

Operational effectiveness aims at performing similar activities better than rivals. By contrast, strategic positioning entails

„performing different activities from rivals’ or performing similar activities in a different ways” ” [Porter].

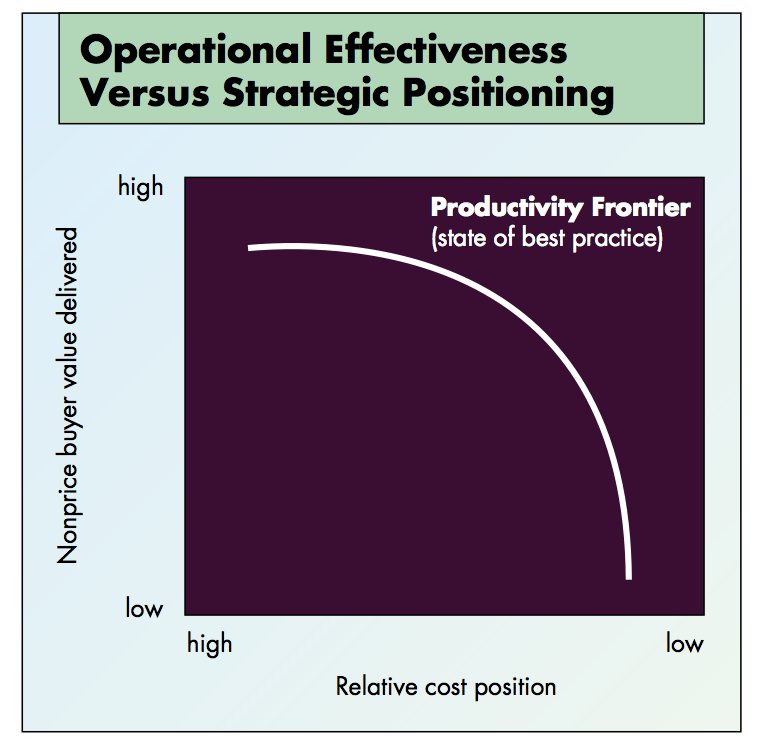

Operational Effectiveness is about doing more for less while Strategy is about being different. Porter calls productivity frontier the sum of all existing best practices at any point in time. This is the best value a company can produce at that time. However the productivity frontier is constantly shifting outward with the introduction of both new technologies and new management approaches. Operational Excellence produces absolute improvement in productivity, which generates relative improvement for no firm (all the gains are captured by customers, technology providers, advisers and consultants).

Strategic Convergence

Alone Operational Excellence leads to strategic convergence (level playing field – all companies become identical). Indeed any improvement gets quickly co- pied and imitated by competitors. By focusing on operational effectiveness only, firms are contesting a race down identical paths. To the extreme, industry consolidation is the only way to escape massive value destruction.

Is Lean Management a strategy ?

Still it became obvious in the 80’s, that the performance of Japanese factories was by far overshooting any American and/or European standard. Despite their lower production volume, they were delivering higher profitability and better quality with lower inventory levels, less space and much faster throughput. The founder of the Boston Consulting Group declared : „until the causes of the differences can be explained the underpinnings corporate strategy are suspect” (Bruce Henderson).

Frameworks to further analyze and understand external & internal factors will be detailed in the section that deals with Value Architecture.

The Five-Forces Framework

This famous framework ( [Porter79] [Porter08a] ) is a tool to analyze the structure of an industry, to describe the intensity of competition and to understand the origin of its long-term profitability level. Porter’s decisive contribution with the Five-Forces framework is in recognizing profitability is not only influenced by the rivalry between direct competitors.

The objective of the analysis is therefore two-fold : on the one hand it delineates the industry and points out its dynamic (what are the long-run performance drivers); on the other, it pinpoints the “forces” that most influence the profitability so that an industry player can seek to fight against these forces and/or shape them to its advantage

A 5-Forces analysis will typically seek to address aspects such as :

- what industries to enter (respectively to exit) ?

- what influence can be exerted ?

- How are competitors differently affected by changes in the industry (e.g. raising barriers by increasing investment spending)

According to Porter, the configuration of the five forces is specific to each industry and rather stable over time.

Resource & Competence

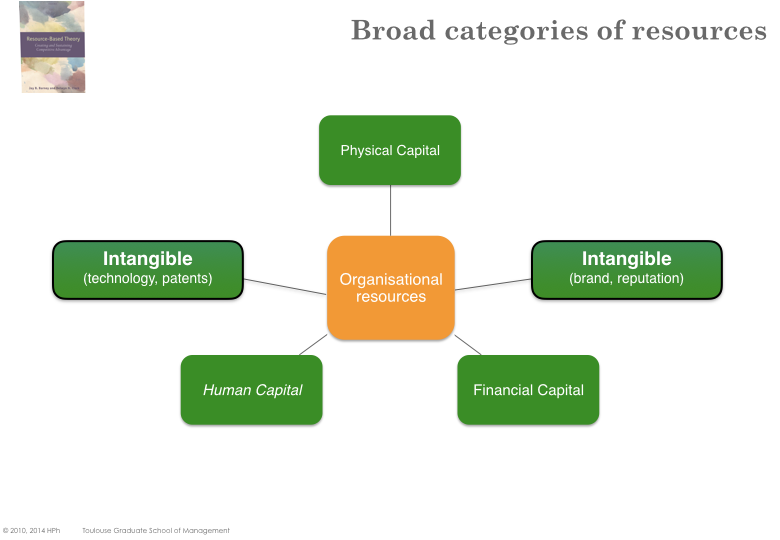

The resources & competences framework can be used to scan the various businesses in which a firm could develop a competitive advantage, based on its existing capabilities. Likewise it may highlight the capability gaps in a given business.

Two broad types of capabilities are usually considered :

Resources are the assets that a firm owns or can call upon (including ties with partners and suppliers). Resources are basically what a firm possesses.

Competences are the way those assets are used or deployed effectively. That is what a firm does well with what they have.

Strategists look in priority for businesses where the existing resources & competences, that the firm already controls, can be exploited. This is often the reason why firms consider, in priority, diversification in adjacent domains (leveraging the existing customer base or extending the existing products to additional customer groups and hence benefit from economies of scale/scope).

A Strategic Capability (resource or competence) contributes to the long-term survival or competitive advantage of an organization.