Market View - Five Forces

The market-based theory of the firm derives from micro economics and industrial organization, in particular from the structure, conduct and performance developed by Bain ( [Bain54] ) . A vast strategic management literature has been devoted to this model, initially articulated by Michael Porter ( [Porter79] ) who is among the most prominent figures associated with the market-based theory of the firm and competition.

According to the proponents of the market-view, competition is central and is and at the core of economic exchanges: „ Competition is one of the society’s most powerful forces for making things better in many fields of human endeavor ” ([Porter, 2008b]). In all his writing, Porter strongly advocates the freedom of unrestricted development in all spheres of human activities and for instance notes that „ Competition has spread all sectors of society worldwide and now embraces fields like the arts, education, health care and philanthropy ” ([Porter, 2008b]).

Two ideas are central to Porter’s beliefs and theory:

Strategy is about being different Porter argues that competitive strategy is about being different, which requires deliberately choosing a different way to deliver a mix of values (i.e. to perform different activities than rivals or to perform activities differently). Outperforming rivals requires establishing and maintaining dissimilarities.

Strategy is about saying no A now classical saying in strategy is: ” you can’t be everything to everybody ”. What is meant is that firms must decide which business they’re in. Then they should focus on that business only. If necessary they should have the courage to turn off some activities / customer groups that do no longer fit their strategy.

To Porter, Strategy is a set of deliberate, consistent and relevant actions that explain why some firm can sustainably over-perform.

Companies are in strategic competition when they choose to adopt different paths. The success of a company shouldn’t depend on the failure of its competitors. [Magreta 11]

This section mainly draws from Porter’s articles.

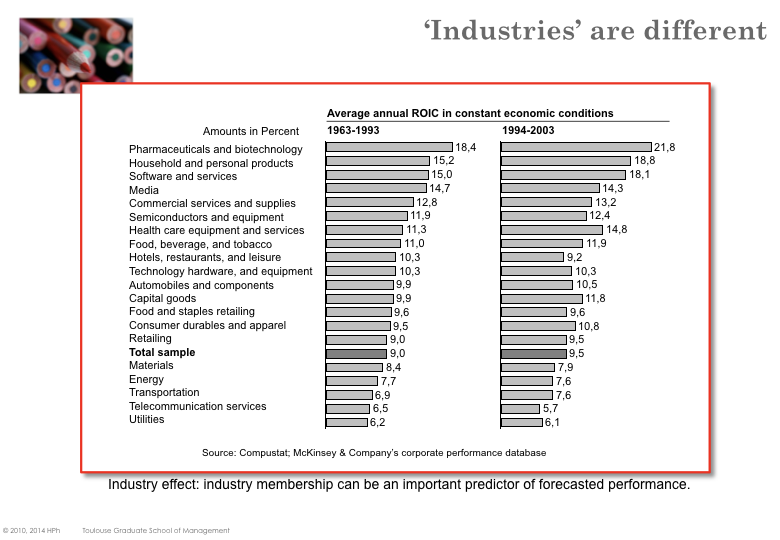

According to Porter, the two major factors that influence how profitable individual firms will be are the industry structure within which they compete and how they position themselves against that structure.

The Five forces

Porter has created various analysis frameworks that establish fundamental logical relationships: i) to be more profitable than others, a firm need to sell at a higher price or to produce at a lower cost; ii) competition within an industry depends on five-forces (see below) and iii) a firm is characterized by a set of activities.

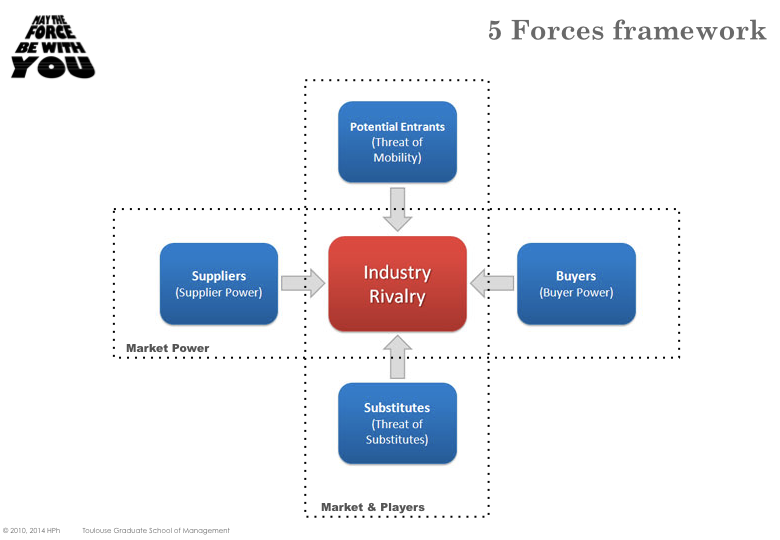

The Five Forces Framework ( [Porter79] [Porter08a] ) is a tool to analyze the structure of an industry, that is to describe the intensity of competition and to understand the origin of its long-term profitability level.

Porter’s decisive contribution with the Five-Forces framework is in recognizing profitability is not only influenced by the rivalry between direct competitors. According to him, the configuration of the five forces is specific to each industry. The objective of the analysis is therefore two-fold: i) it delineates the industry and points out its dynamic (what are the long-run performance drivers) and ii) it pinpoints the “forces” that most influence the profitability so that an industry player can seek to fight against these forces and/or shape them to its advantage.

«With the ‘Five Forces’, my goal has been to develop rigorous and useful frameworks that efficiently bridge the gap between theory and practice » – [Porter, 2008b].

«In essence, the job of the strategist is to understand and cope with competition. Competition for profits goes beyond established industry rivals to include four other competitive forces as well : customers, suppliers, potential entrants and substitute products. The extended rivalry that results from all five forces defines an industry’s structure and shapes the nature of competitive interaction within an industry. […] The point of industry analysis is not to declare the industry attractive or unattractive but to understand the underpinning s of competition and root cause of profitability » – [Porter,1979].

Companies in the competitive field should not be defined in terms of product types, but rather in terms of the customers needs they served. This encourages decision maker to more precisely identify new entrant / substitutes and as well broaden the potential growth opportunities spectrum.

Competition forces are not specific to any specific firm but on the contrary, apply identically to all the firms in the industry. According to the Market-Based paradigm the structure of an industry underpins attractiveness, as it is the sole determinant of mid to long-term profitability.

Intense forces will tend to reduce industry profitability and no firm will earn attractive returns. By contrast, when forces are softer, players can generate profit in excess to their cost of capital. The five forces framework helps assessing the market Power.

The market power of a firm is its capability to establish prices that exceed their marginal costs and therefore generate a sustainable higher performance.

An industry analysis should include quantitative elements as much as possible: „the effects of the forces are directly tied to the income statements and balance sheet of industry participants” ([Porter, 1998]). The analysis should not be limited to drawing the static picture of current forces but should also seek to anticipate shifts in each force and forecast how it might trigger reactions in the other.

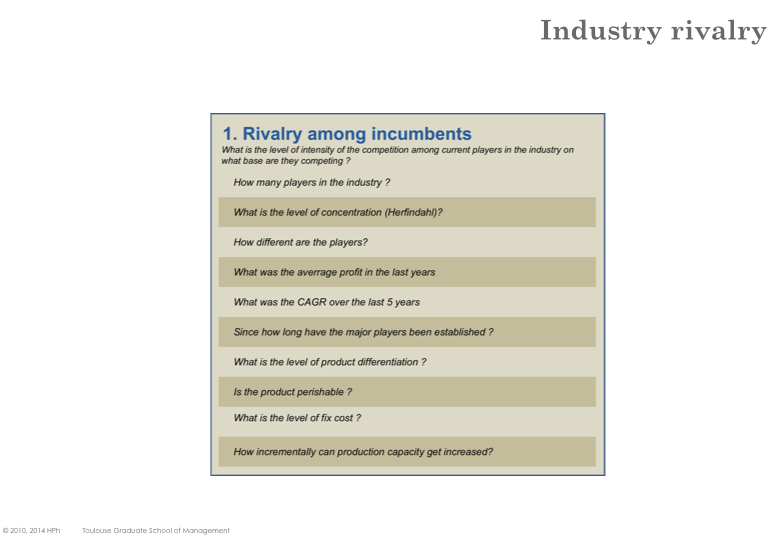

Five forces - Rivalry among incumbent players

Rivalry, the most obvious form of competition, can take many different forms: advertising campaigns, pricing, promotion and special offers, enhanced services, etc. How much rivalry impacts an industry’s profitability depends on the intensity with which firms compete but also on the basis on which they compete. Rivalry intensity is higher if:

Many competitors usually increase rivalry. Indeed, establishing practices advantageous for the industry (as a whole) requires either a strong leader or a small group of competitors (oligopoly). Small number of players facilitate collusive behavior (a collusive behavior is a strategic anticipation and not an explicit agreements between firms - collusion- which is usually forbidden by antitrust laws). By contrast, the risk of war price increases with the number of similar players and/or when they all are of similar size and power.

Competitor diversity measured by the degree of integration, diversification, geographical location etc. The more similar the players the more likely collusive behavior. Conversely dissimilar firms are likely to seek to adopt more innovative and aggressive behavior, which will impact industry profitability.

Industry growth is limited (i.e.the industry is mature r declining). Players can only grow their market shares at the expense of the others (zero sum game). In non-mature markets, some players may also reduce unilaterally their prices and seek to capture big market share to be well positioned when the market gets mature.

Exit barriers are high for instance there are specific assets or significant sunk costs – as firms can barely escape the industry, they will try to maintain themselves in the industry (in the hope of an economic recovery) as long as their losses are less than the exit costs. This usually creates overcapacity and drives price down for all players even the healthier.

Some players have non-economic goals (e.g.image, employment, family owned business, CEO’s ego and prestige). Such high commitment to the business can lead to non-rational actions and decisions and become detrimental to the complete industry.

Firms cannot read each other’s signal for instance due to a lack of familiarity with each other, cultural difference, unclear goals, diverse approaches to competing.

Rivalry can occur on various factors. However it is higher if it focuses on price only when:

Little differentiation low customer loyalty (no brand value, the image or reputation of the vendor makes no difference), the products and/or services are perceived as equivalent (commoditization: the goods are becoming simple commodities in the eyes of the consumers), buyers are facing little switching costs when changing providers.

Fix costs are high and marginal costs are low volume becomes a major strategic parameter (economies of scale) and therefore all the players are tempted to reduce their price with the objective to i) capture more market share, ii) reduce their unit costs and iii) restore their long-term profit.

Capacity must be expanded in large increments to avoid diseconomies of scale (e.g. new plant set-up). As a result, production increase far exceeds demand and overcapacity drives profitability down for the complete industry.

Perishable product product that cannot get stocked (e.g.fresh vegetables) or goods that will soon get obsoleted (high tech products) or for which unsold capacity can’t be recovered (e.g. consultant or physician time, airline seat on a particular flight). Again, overcapacity will drive profitability down for all the players.

When competition apply on attributes other than price (e.g. enhance feature, better quality, complementary services), then the impact on industry profitability is more limited. Indeed, the enhancement usually translates into a higher perceived value which allows a price premium. It also raises entry barriers and reduces the threat of entry / threat of substitutes.

Rivalry among competitor relates to competition between firms that are already members of the industry. In large industry with many players, rivalry can be homogeneous (all players compete on similar attributes) or segmented (sub-groups compete on different attributes). To the extreme (perfect competition) no player can generate any profit in excess to its opportunity cost. In other words, the industry doesn’t generate any economic return.

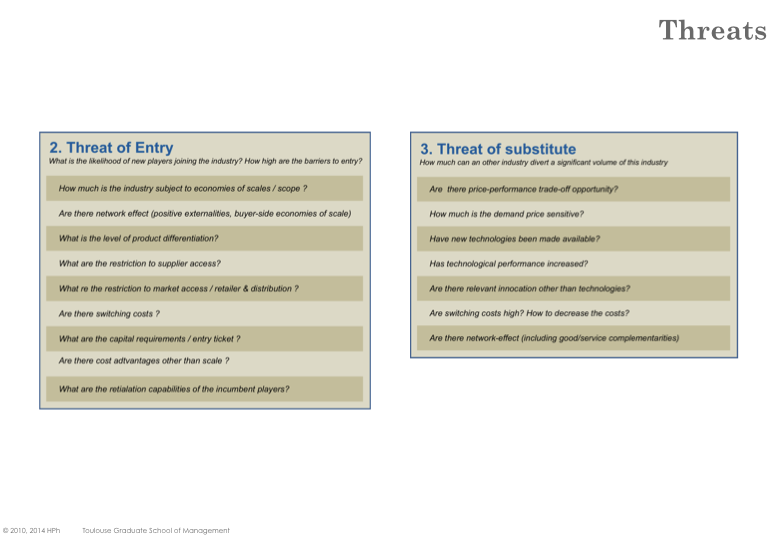

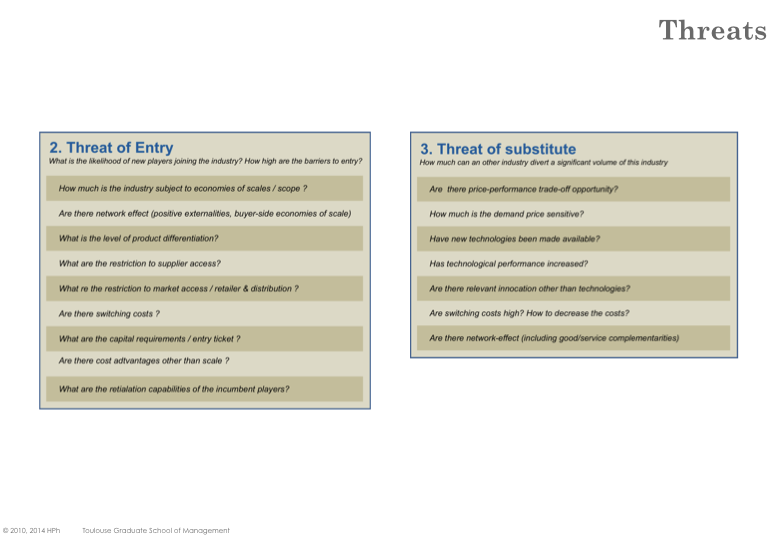

Five forces - Threat to entry

Potential new entrants are firms that despite not being part of the industry yet, are threatening to enter and can be seen as latent players.

Incumbents have an incentive not to increase too much industry performance (i.e. their profit) as otherwise additional players will join and seek to grab market share, which would put pressure on price and elevate costs (e.g. increased R&D, marketing expenditure, etc).

Potential new entrants already established in other industries are even more threatening as they may leverage their existing capabilities and capital to shake up existing competition. Incumbents can deter new entrants by keeping their prices at rather lower levels and continuing to innovate and invest (which also reduce profit).

Competition authorities (anti-trust) consider that some markets (coined contestable markets by economists) are characterized by competitive equilibria despite being served by a very small number of players. In other words, the threat of entry is sufficient to cap profit (i.e. the part of value captured from customers).

Barriers to entry increase with: - Supplier-side economies of scale – firms that produce higher volume enjoy lower unit costs (fixed costs are averaged on more units, more efficient production processes & equipment, better terms & conditions from the supply base). A new entrant may either chose to produce a limited volume (and face far higher unit costs, which affects profit) or enter the industry directly with a large production volume (and experience significant overcapacity for a while).

Network-effect (aka externalities, Buyer-side economies of scale) were the willingness to pay of buyers increase with the number of users of the good.

Switching costs that a firm may incur (usually up-front, sunk costs) when moving from the installed supplier to a new one. This barrier is reduced for fast growing markets as incremental customer (i.e. new customers) don’t face switching cost.

Investment needs to enter the industry (eg.fix assets: plants, equipment or working capital: inventory build up, customer credit or SG&A costs: development, advertising, etc) may be high. While large established firms may have both the willingness and financial capabilities to enter the industry, huge capital requirements is likely to reduce the number of prospective entrants. However, if the returns of the industry are attractive and are expected to remain so, potentially any new entrant can raise the funds from the capital market.

Other cost advantage that incumbents may enjoy independently of their production volume (Ricardo rents). The may for instance, benefit from better access to key suppliers, protected patents, attractive geographic position, established brand recognition and reputation. In such a situation replicating the industry’s cost structure can be very challenging. However new entrant may decide to alter the current business model to counter the advantage of the entrenched players.

Market access/distribution channels the more limited the wholesale or retail channels, the tougher the entry. Nevertheless, new entrant may decide to short-circuit existing distribution channels and create their own.

Regulation and government policies can limit (e.g.licensing requirements, patents, intellectual property rights), forbid (e.g. restriction on foreign investment) or on the contrary, incentivize entries (subsidies, public R&D investments).

Expected retaliation How incumbents would respond to a new player entering the industry can also be a barrier to entry, provided that incumbents are committed to defending their market and let it know (e.g. public statement, historical behavior). The more available resources (e.g. cash) the stronger the resistance (war price, quality increase, advertising) and higher the entry barrier.

The threat of entry relates to the (potential) competition between a firm (the new entrant) and all incumbents players. If the threat materializes it impacts the market shares of entrenched players. High barriers to entry prevent additional players to join an industry. From the perspective of incumbents, barriers to entry protect the industry and protect profitability. Incumbents (especially in concentrated industries) will seek to in- crease barriers, for instance through contractual set-up (exclusivity, franchise, alliances) and lobbying actions.

«If entry barriers are low and new comers expect little retaliation from entrenched competitors, the threat of entry is high and industry profitability is therefore moderate» – [Porter, 2008b].

Incumbents will be particularly successful at strengthening entry barriers when:

They can mobilize significant capital resources (cash, credit access)

They are concentrated and can lock-in suppliers and customers

The industry is mature with low growth

Five forces - Threat of Substitutes

A substitute is a product or service that would be considered by customers as equivalent to the industry’s products. It has comparable functional attributes but is often based on different technologies (e.g. domestic flights vs. high-speed train, video rental shop vs internet video on demand).

Incumbents may fail to identify early enough substitutes, as they can be very different from the products currently offered by the industry (shop-around- the-corner vs amazon). An industry with little substitutes (rigid demand) is structurally more profitable.

Substitutes may emerge through technological innovations (e.g. wide deployment of the Internet), performance improvements of existing technologies (PC replacing mainframes), breakthroughs in cost structure, integration of various functions in a single product.

An industry will seek to reduce the threat of substitutes by lowering its own prices and/or increasing the product’s quality and features (so that customers will continue to prefer the industry’s product).

The threat of substitutes is higher if:

Attractive price performance trade off can be offered, for instance through proposing different value-proposition (usually less sophisticated but much cheaper product) and increase the utility of some buyer groups.

Low switching cost are associated with current products - i.e.there is little or no network-effect and customer loyalty is low.

Price sensitive customers i.e. price-elasticity of demand is high - customers will tend to switch to any alternative, provided that price can be made more attractive.

«Every once in a while, a revolutionary product comes along, that changes everything. In 1984, Apple created the MacIntosh. It didn’t change only Apple, it changed the complete computer industry. In 2001, we introduced the iPod, it didn’t just changed the way we lis- ten to music, it changed the entire music industry. Today we are introducing three revolutionary products of this class. The first, is a widescreen iPod with touch control, the second a revolutionary mobile phone and the third is a breakthrough internet device. … An iPod, a phone and an internet communicator … these are not three separate devices, it is one device that we called an iPhone. Apple is going to revolutionize the Phone. » – Steve Jobs, 2007.

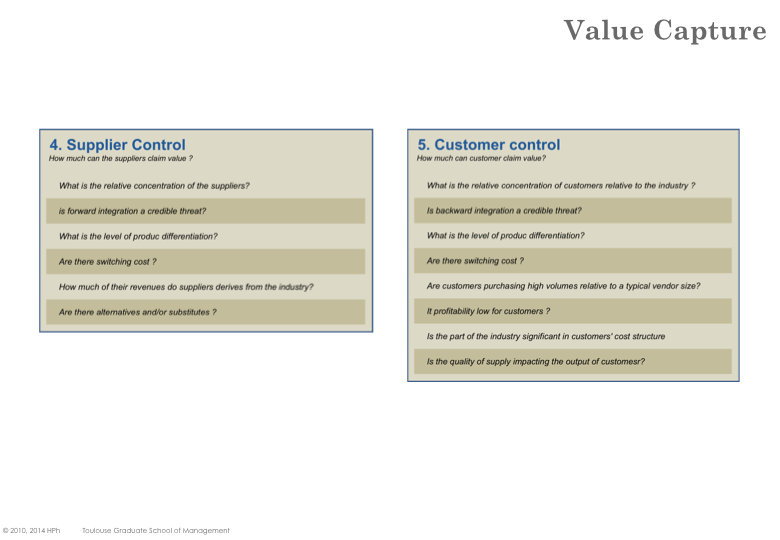

Five forces - Supplier / Buyer Power

These two forces depict how the participants that belong to the same value system (aka supply chain) can grab value. They have convergent interest in increasing the total created value, however they all seek to capture more of the value for themselves. This is clearly a zero sum game what one side wins, the other side looses.

If suppliers (including suppliers of labour usually represented by their unions) increase their transfer price, then industry profitability is likely to decline, except if industry participants can pass on the increase to their own customers. The reasoning that applies between suppliers and industry players, also applies between industry players and their customers.

A supplier group is more powerful if:

It is more concentrated than the industry is sells to (in other words, the most concentrated end has more power).

It derives limited revenues from the industry and has a well balanced portfolio of customers. The more dependent of the industry the suppliers, the less market power.

It offers highly differentiated products and/or services - commodization on the contrary leads to reduced power.

- It can credibly integrate forward into the industry. Powerful customers can reduce industry profitability by driving prices down, requesting enhanced quality and/or services or playing industry participants

A customer group has more leverage if:

They purchase high volumes relative to the size of a typical industry participant,

Products are standardized and/or undifferentiated (commoditization) or they enter into the production of an end-product and their quality has little impact on the quality of the end product. In such a situation buyers will face many potential suppliers, which highly increases their bargaining power. By contrast, if the inputs from a vendor are determinant (quality, performance, specific knowledge) then buyers will become less price sensitive and their willingness to pay will increase (until they find a substitute).

Limited switching costs if any, when a customer changes its provider (transaction costs, transfer of work, risks).

Integration threat Customers can credibly integrate backward into the industry

Customer groups will have incentives to use their market power if their profitability is low and/or they are suffering cash issues or if the product/service they procure:

represents a significant part of their cost structure Buyers are more price-sensitive for the items that represent a high portion of their costs. By contrast, ’small items’ usually enjoy relatively better conditions.

doesn’t impacts the quality of their own products Buyers view the product/service as a commodity and are ready to switch to a new supplier if necessary.

Market Power vs Negotiation Power Market power is a characteristic of an industry as a whole (and applies equally to all players in that industry). It corresponds to the transfer of economic rents among the various stages of the production process (from raw material to end product). Market power reflects the ability of industry players to influence pricing mechanisms, raise price above marginal cost and earn a positive profit. Adopting collusive behavior and/or limiting supply are typical behaviors that signal market power. Market power is also linked to the elasticity of the demand curve. By contrast to market power, negotiation power is specific to a given player (may vary across the various players of a same industry). It reflects the ability of the player to impose its preferences to its eco-system. For instance, large players will more easily obtain good conditions from their suppliers or retailers.

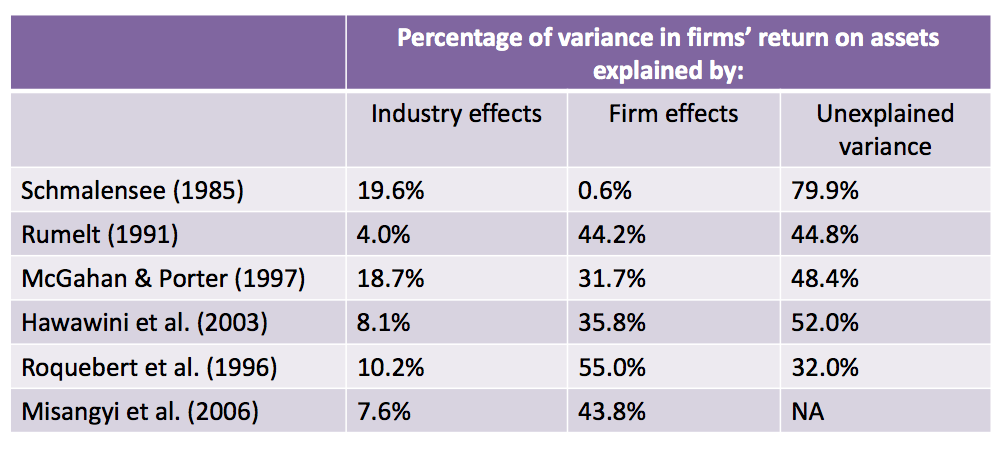

How much does the various effects account for ?

Grant( [Grant91] ) mentions several studies performed by different scholars that sought to establish the respective importance of the network and respectively firm effects. None of the analyses are considered as decisive. Still it shows that although there is an industry effect, it is usually not fully explaining the overall performance.