Porter Generic Strategies

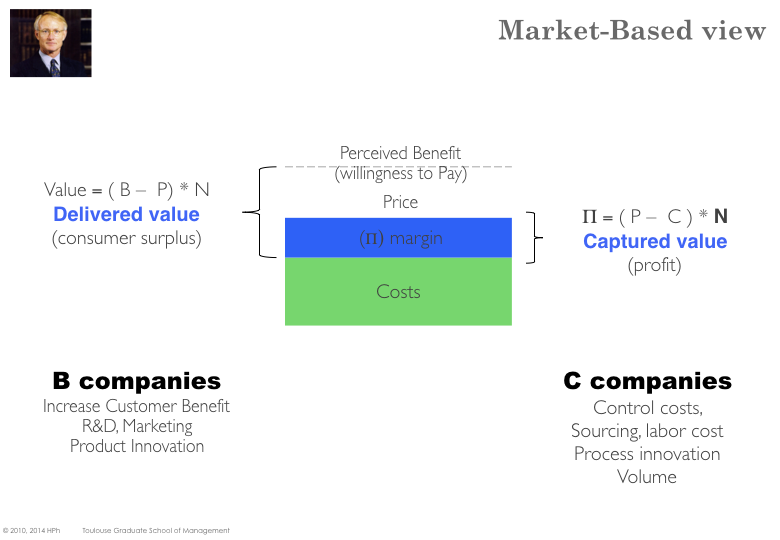

To be competitive at all, a firm must ensure that all its customers see sufficient value so that they are prepared to purchase its products and services at a price that exceeds the costs of supply. In addition, if the firm has a advantage it becomes able to claim more value than its competitors.

As stated by Besanko, a firm can generate more economic value than others by either i) configuring its value chain differently from competitors or ii) by performing activities better than rivals, while configuring its value chain essentially as all the others.

PORTER’s Generic Strategies

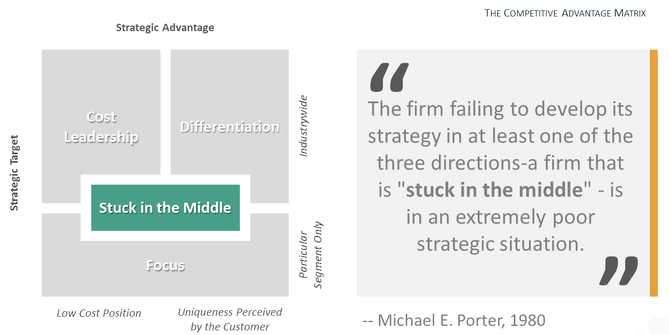

For Porter and the Positioning School there are two fundamental ways, to set a firm apart from its competitors and build an advantage:

Differentiation delivering greater value to customers in exchange for a premium. There are fundamentally three sources of differentiation : product attributes (innovation, quality), pseudo-differentiation (advertising, brand notoriety) and geography.

Cost leadership creating comparable value far more efficiently than competitors. A firm undergoing a cost leadership strategy will be characterized by very thigh cost discipline and will for instance, seek to benefit from economies of scale and scope.

In addition, Porter adds a further dimension subject to the scope that the business choses to serve. Indeed a company can either focus on narrow customer segments or target broad range of customers.

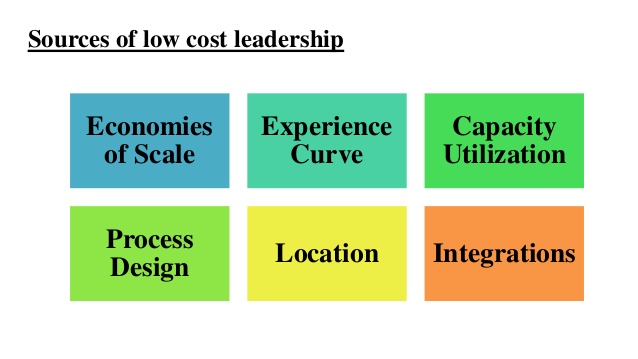

Cost Leadership

A firm seeking to undergo a cost leadership strategy, will concentrate on the following drivers:

Reduce input costs labor, raw materials, procured components. The firm is also likely to consider relocating some activities to low cost countries.

Seek economies of scale increase production volume to reduce the ave- rage cost per unit (e.g. fixed costs amortization, …).

Seek experience effect speed-up production ramp-up and steepen the learning curve which improve staff productivity. Early entrants may gain an advantage. Likewise firms gaining and holding the highest cumulative volume are better off.

Design Process Approaches such as DFM (Designed for Manufacturing), DFA (Designed for Assembly), Lean management, Six Sigmas to optimize workflow & process efficiency.

Cost leadership implies having the lowest costs in the industry. There can be only one cost leader per industry. Firms shouldn’t pursue a cost leadership strategy in total disregard for quality. They basically have two options:

Parity in service /product. The firm offer a product/service that has the same perceived value than other products in the market, trades at the same price but can be produced at a lower cost. The cost advantage trans- lates into extra profit compared to the average firm.

Proximity The firm decides to downgrade some characteristics of the product which allows for far more efficient costs while not translating into large price cut.

Differentiation

A differentiation strategy involves uniqueness along some dimension, that is sufficiently valued by customers to allow a price premium. Various competitors may select different dimension and therefore there might be more than one differentiation strategy.

Usually differentiation comes at a cost (e.g. additional R&D, additional capex, branding, customer care, etc). Firms however, must check that their customers are ready to pay the product/service in excess to these additional costs.

It should be underlined that a higher perceived value means that (some) customers recognize that the product/service is superior and are are willing to pay more for it. This should not be confused with offering a different value pro- position which may not necessarily yield higher prices.

Focus Strategies

A focus strategy targets a narrow segment of a domain of activities and tailors its products and services to the needs of that specific segment to the exclusion of any other.

The focuser achieves competitive advantage by dedicating itself to serving its target better than any other competitors can do. For instance, Ryanair targets price sensitive passengers with no need to connecting flights.

Successful focus strategies depend on:

Distinct Segment Needs should the distinctiveness of the segment erode, the advantage of focussing would vanish. For instance, RIM initially targeted its BlackBerry at business users. As there are no longer any difference between a mobile phone for business purpose and for general purpose, RIM has lost its advantage and is struggling to stay in business.

Distinct Value Chain addressing distinct customer groups with different means (i.e. more efficiently that what non-focussed competitors would do).

Viable Economic Segment to be successful, a focus strategy must tackle a business segment that is large enough. The demand must be sustainable and solvent.

Stuck in the middle

According to Porter, firms must choose between the three generic strategies. Any attempt to compromise and combine more than one generic strategy would result in destroying company value.

Complement: Porter’s Positions

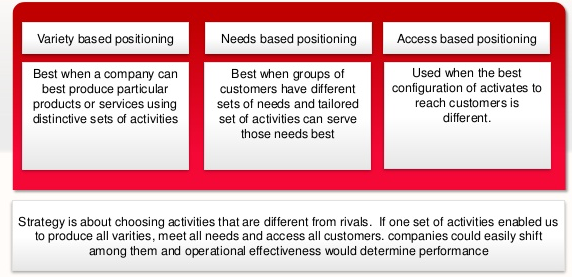

At a more detailed level, strategic positions emerge from three sources ( [Porter98] ) that are not mutually exclusive and often overlap.

Variety-based positioning produces a subset of an industry’s products or services. It is based on the choice of product or service varieties rather than customer segments. Thus, for most customers, this type of positioning will only meet a subset of their needs. It is economically feasibly only when a company can best produce particular products or services using distinctive sets of activities.

Needs-based positioning serves most or all the needs of a particular group of customers. It is based on targeting a segment of customers. It arises when there are a group of customers with differing needs, and when a tailored set of activities can serve those needs best.

Access-based positioning segments customers who are accessible in different ways. Although their needs are similar to those of other customers, the best configuration of activities to reach them is different. Access can be a function of customer geography or customer scale or of anything that requires a different set of activities to reach customers in the best way.

Challenging the reference value proposition

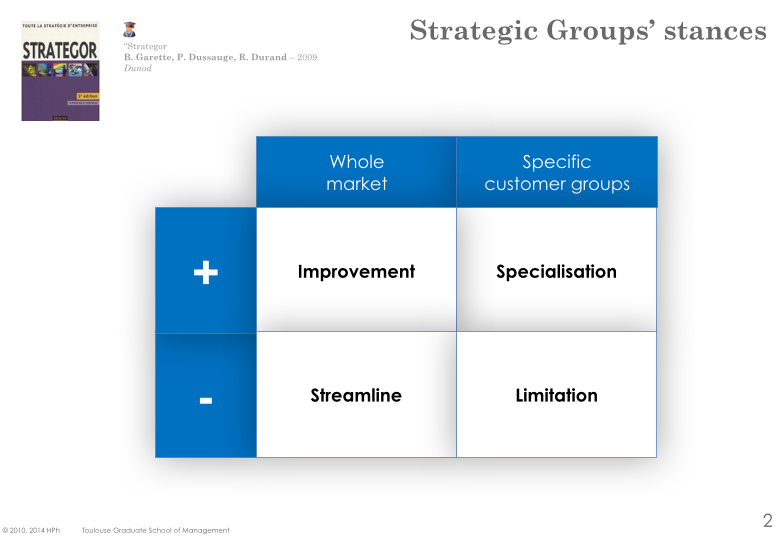

In any market, the value proposition offered by the larger bulk of firms (dominant strategic group) is the reference and other strategic groups need to differentiate from that standard.

Improvement better value proposition for the market as a whole, which shifts the reference value proposition.

Specialisation value proposition specifically targeted to a dedicated market segment (specific needs e.g. extra-large size in the clothing industry).

Streamline offer a simplified product/service at lower costs.

Limitation low cost offer dedicated to a specific market segment.

The issue with the limitation/streamline approaches is one must ensure that i) there is a sufficient creditworthy market and ii) the value proposition is not too far from the reference offer.