Value Chain

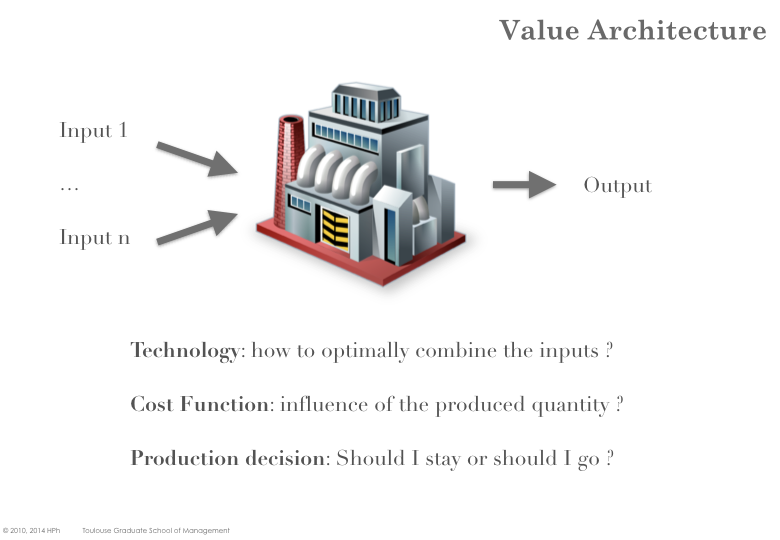

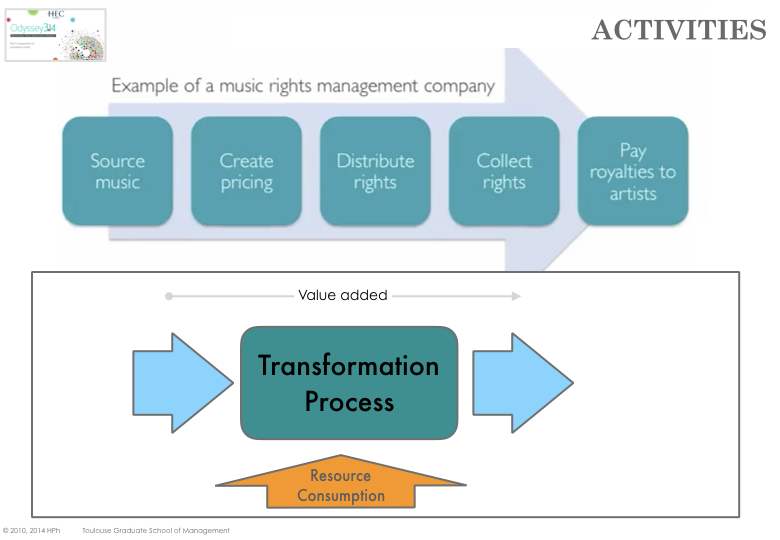

A Firm transforms inputs into outputs

Any firm, whether it produces products or services, transforms some inputs into outputs (aka Value Propositions). Inputs typically range from raw-materials, labour, intermediate products, consumables.

Note: the transformation process may also require items (e.g. machinery) that can be used repeatedly. Such items are called Capital Equipment and are not transformed in the process.

Economists call inputs factors and say that firm combine factors. They also represent the transformation as a so called production function. The function is characteristic of the technology (i.e. production processes) used. For a given production function, the output (and therefore the cost of producing the output) is a function of the various inputs.

A variation in outputs/inputs will translate into a variation in costs. Moreover the variation in costs in usually not linear (producing more doesn’t necessarily imply overspending in proportion). Value Architecture is therefore aiming at finding optima, all things being equal.

Besides, Value Architecture is also concerned with looking for and introducing new production functions, that is new ways of generating similar results (aka process innovation / technology innovation).

Usually a single firm will not transform raw materials into end products / services. By contrast, firms will specialize into some segments of the so-called Value System (the sequence of all the intermediate value chains from raw materials to final products).

Business ecosystems are „ are heterogeneous coalitions of companies from different sectors, forming strategic communities of interests or values and structured in networks around leaders that are able to impose or share their commercial visions or technological standards ” (Torres-Blay).

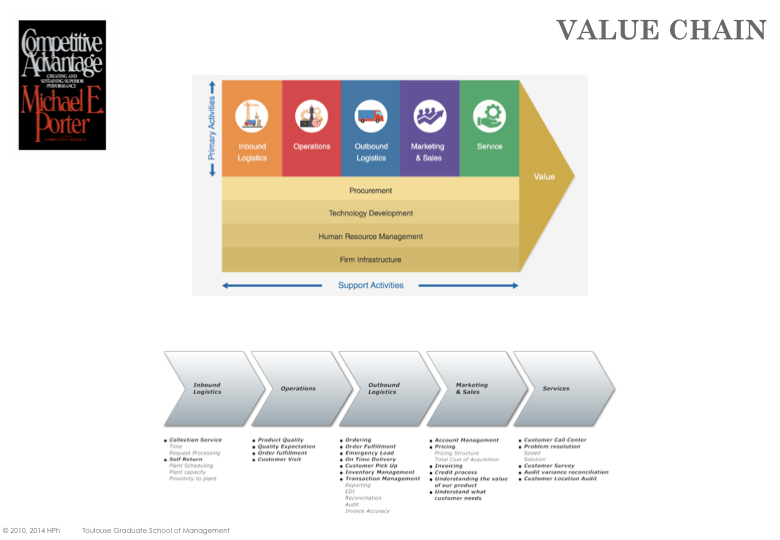

Notion of Value Chain

The concept of Value Chain was introduced by Porter ( [Porter85] ) in its seminal book. An internal value chain is the description of all the steps taken by the company to deliver the value proposition to their customer. It identifies the firm’s activities and their interaction. The model applies to one specific business (i.e. at business strategy level and not at corporate strategy level).

Classically activities are broken down into primary activities (directly adding value toward the output) and support activities (that contribute indirectly to the output or are non adding any value to the product/services but are mandatory, for instance accounting).

The actual list of activities and the relevance of the categories are highly dependent on the type of business. For a multi-product firm (where support activities are shared among various business lines) the analysis can become tedious and allocating support costs to the various products can be very subjective.

However, when establishing a business case for a new product/service line, the value chain framework is a good framework to ensure that some activities are not neglected and/or some costs are not under-estimated. The value chain analysis is actually two-fold: identifying the sequence of activities and, for each and every activity, characterize how inputs are transformed and which resources are used / consumed in the process (cost structure and value addition to the customer).

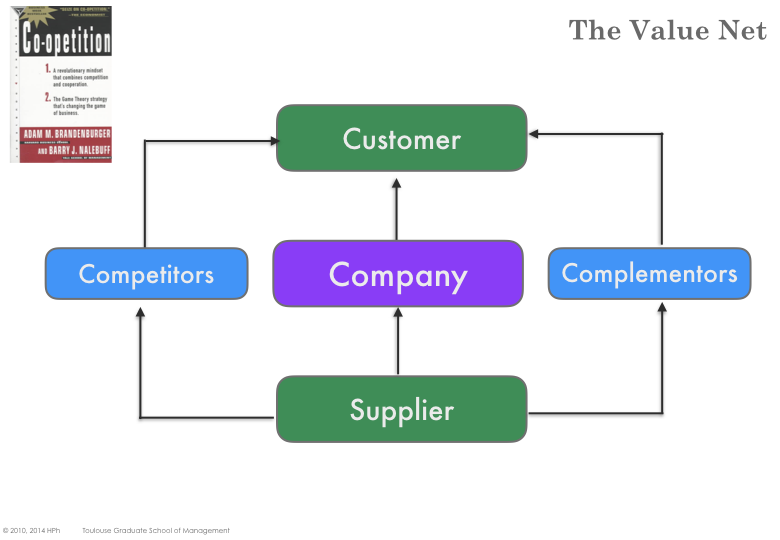

Notion of Value Network

The classical view is that firms should operate in a clearly defined segment. Firms that belong to the same segment are competitors and they interact with suppliers & customers.

Brandenburger and Nalebuff ( [Brandenburger96] ) two game theorists, offer a different perspective. Their central idea is that „You don’t have to blow the other fellow’s light to let your own shine” (B. Baruch). Most busi- nesses do benefit from the success of other players and Mutual success often exceeds Rivalry.

With the Value Net approach, companies can cooperate to grow the pie before they compete to share it. You can often be better off by collaborating with others to make the pie bigger (even if your share remain stable in percentage) rather than claiming a bigger part of a fixed pie (i.e. stealing from somebody else).

„A player is a complementor if its value proposition increases the perceived value of your product / service” [Brandburger96]

Intel and Microsoft are complementors for the PC market. More performant microprocessors as well as more powerful operating systems increase the value of PC. Likewise, content providers (e.g. music producers) are complementors to i-Tunes: the more artists available for download, the more value for end-users.

„Economists call this a network effect (positive externality) or a demand-side economies if scale. When the network effect is present, the value of a product or service is dependent on the total number of customers using it”.

Products or services that highly depend on network effect (i.e. multi-sided models) are very sensitive to quickly achieving the critical mass of users and enjoying positive feedback. Successful Value Propositions can benefit from a bandwagon effect where the rate of adoption becomes proportional to the number of people who are already using the system.

„The opposite effect (i.e. the value of a product decrease with the number of users) is called negative network effect or congestion.”

Sometimes, the same company can launch products that are complementors to their main business. Michelin – the tyre manufacturer – produced maps and touristic guides to encourage car trips and increase wear and tear of tyre.

Companies may fail to enter a market for lake of complementors. Brandenburger and Nalebuff mention the examples of Alfa Romeo and Fiat – two Italian car makers – who sought to enter the American market but had to throw the towel because no distribution / repair network was available (and establishing one was far too expensive).

Competition must be understood in its broad sense, that is including incumbent players but also new potential players and substitutes. As already discussed in the chapter about Value Proposition, the key question should be: what else my customers could buy to serve the same need.

Example: The Value Network of TSM

Considering the case of an University (e.g. Toulouse Graduate School of Management in the role of the Company), yield to the following roles:

Customers Students are obvious customers (both current and prospective students). In addition the Families of the students (mainly their parents) would also be considered as customers. Likewise potential Employers should be contemplated as customers (with a different value proposition).

Competitors other Education Institutions (Universities, Schools, etc) are obvious competitors. Other Faculties from the same University would also to some extend be competitors. MOOC (Massive On-Line Open Course) and more generally distance learning should be looked at as competitors.

Complementors Some competitors could as well be complementors through a better alignment of offerings: MOOC, Universities. The availability of Housing, Entertainment, Cultural offers and an efficient Transportation System typically increase the Value Proposition of a University. Likewise the availability of part-time jobs for students or student loans could as well increase the University’s Value Proposition.

Suppliers The Faculty and teachers are obvious suppliers to the University. Book publishers and training material producers would as well be suppliers. In addition, Sponsors, Donators, the State and local administrations should as well be considered as suppliers.