Complements

Business Model Patterns

This section briefly explores six very common and famous business model patterns ( [Osterwalder10] ) . Patterns must be seen as general, re-usable archetypes or architectural design ideas that can inspire new business models. This is a non-exhaustive list and other patterns could be considered as well.

Most real life business cases are often a mix of several patterns. Understanding the patterns helps unveil the characteristics, building blocks and profit equation logic of real businesses. It can also support business innovation in suggesting how an existing business model might evolve.

It is key however to identify under which conditions a given business model pattern is effective. Otherwise patterns could be inappropriately applied.

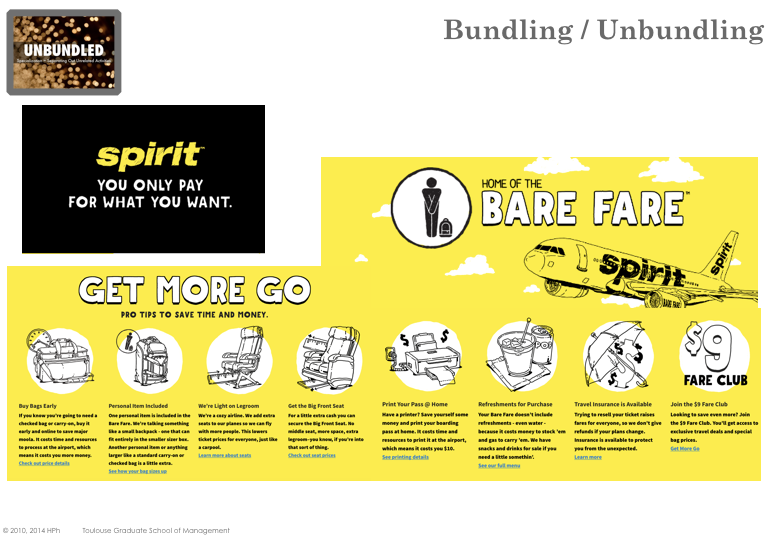

Bundling / Unbundling

Unbundling is the process of breaking apart the various components of a product of service. Conversely bundling consists in grouping several items into a single Value Proposition.

Unbundling allow for low-end differentiation: a lower price is offered as less features are included into the product/service. Low cost airlines are canonical examples of unbundling (additional services such as carry-on / check luggage, seat booking, extra leg room, printed ticket, on board refreshment, …, are billed on top of the fare).

More recently and in the context of the Internet, unbundling usually also suggests the dematerialization and supply of contents at scale and cost unmatchable by former physical suppliers (e.g. MOOC vs in-class courses).

In the context of corporate strategy and mergers & acquisitions, unbundling can mean that a company with several lines of business is split and sold off in parts.

Competition Authorities (e.g. EU) are usually very keen to foster unbundling and limit market power & monopolistic situations. In Europe, the deregulation in the areas of Telecommunications, Railway Transport and Energy came with unbundling measures (e.g. separation of transport network and services to subscriber, separation of railway infrastructure and trains, separation of energy production and energy distribution).

Pay per X

Many business models still rely on cash-for-product: the revenue stream is associated with the transfer of ownership of a tangible product.

However there are many more ways to receive payment and innovative business models can be designed by offering different billing schemes.

In pay-per-view or pay-per-use models the transfer of ownership of physical goods (e.g. purchasing a DVD) is replaced by a right-to-use service (e.g. watching a film). This scheme has been used by many brick-and-mortar businesses (e.g. Cinema, Hotel, Public Transport) and is becoming even more trendy with the Internet (car-pooling, cloud computing, etc…).

Subscription models are a form of pay-per-use services where nearly unlimited consumption is allowed for a certain period of time (e.g. Netflix, Safari on-line, Kindle). For instance, in the anticafé you don’t pay for what you drink or eat but for how long you stay.

With Power by the hour services, an OEM (car manufacturer, aircraft manufacturer, etc) takes responsibility for the maintenance, repair and overhaul for a flat-fee loan.

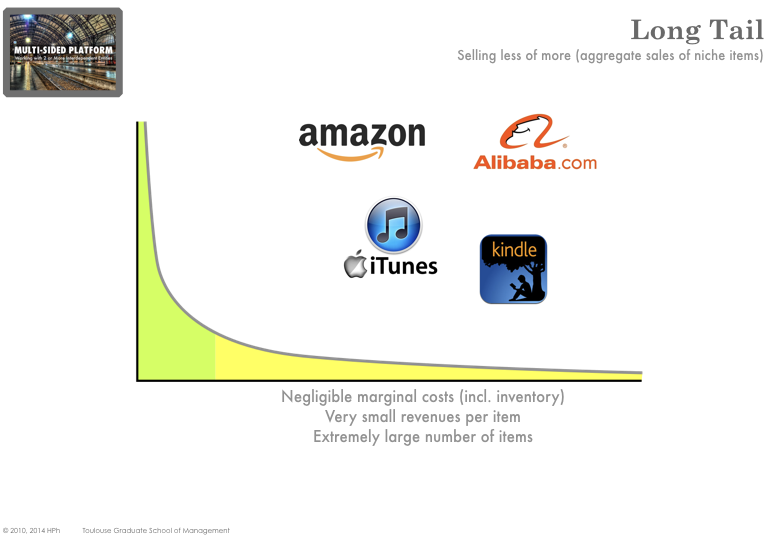

Long Tail

Although the phenomenon is well known from statisticians, the term long tail was first coined in business by Chris Anderson in 2004 in Wired Magazine and extended later in a book ( [Anderson06] ) .

The main idea is that items in very low demand can still collectively make a significant market, provided that the costs of supply remain marginal (distribution, inventory, sourcing, …).

The model can barely be implemented by brick-and-mortar stores because the demand they are facing is not sufficient. By contrast, internet distribution allow players to address very large audience of potential customers which makes the model economically viable.

In the Wired Magazine Blog Josh Petersen, a former Microsoft and Amazon executive, described the long tail as “We sold more books today that didn’t sell at all yesterday than we sold today of all the books that did sell yesterday.”

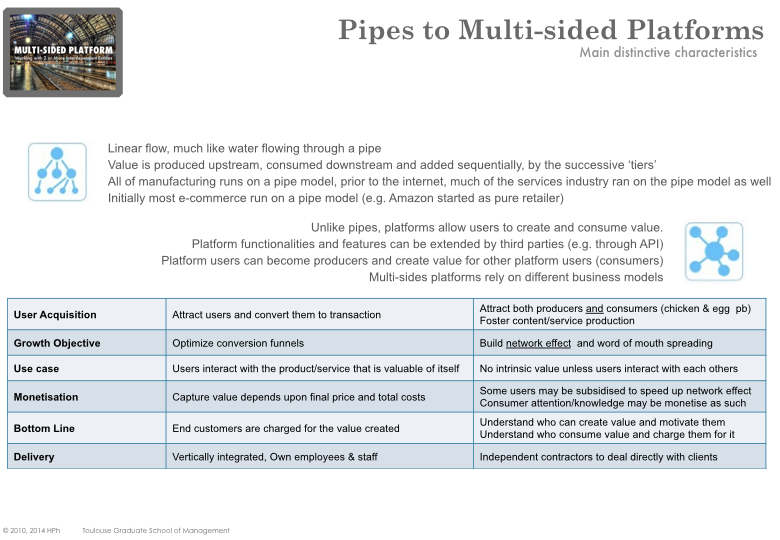

Multi-sided

“Multi-sided Platforms bring together two or more distinct but interdependent groups of customers. Such platforms are of value to one group of customers only if the other groups of customers are also present. The platform creates value by facilitating interactions between the different groups. A multi-sided platform grows in value to the extent that it attracts more users, a phenomenon known as the Network Effect. Network effects and Positive feedback loops are economic terms that describe the snowballing benefits to front-runners in some markets.” ( [Ankaraju10] ) .

Multi-sided platforms (including two-sided) are not specific to Internet Businesses and have long existed before (e.g. credit card network, classified ad publications, etc…). The term platform refers here to the organization that enables interactions between the distinct types of affiliated customers.

Nevertheless Internet Businesses are leveraging Multi-sided businesses like never before, as it allows for further segmentation/customization.

For multi-sided business models, it is paramount to identify the various types of customers and delineate their core interest/benefits. Then it is even more important to ensure that some of the total value created can be captured by the platform.

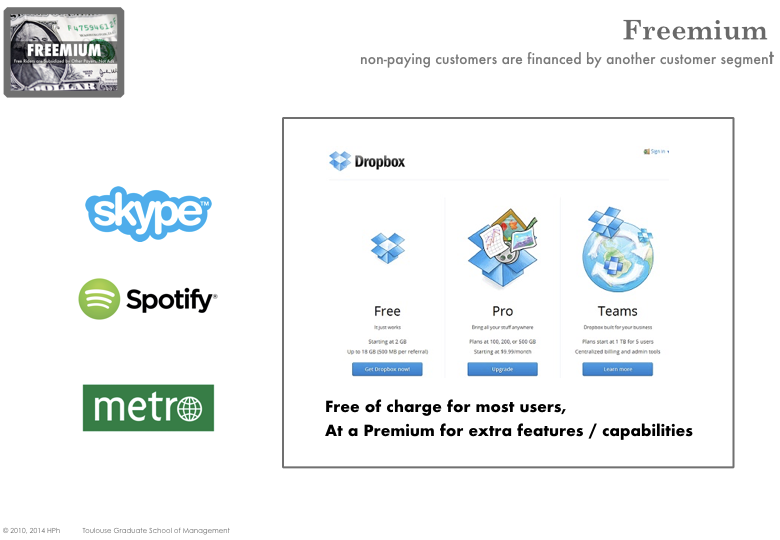

Freemium

Freemium is defined by wikipedia as ”a pricing strategy by which a product or service is provided free of charge”.

Freemium is extensively used by the software industry where pieces of soft- ware can be used free of charge (shareware) or the source code is made available for anyone to read, inspect or modify (open source). According to E. Seufert ( [Seufert14] ) one of the main reasons for deploying a Freemium business model is to quickly and efficiently acquire a large customer base through word of mouth, referral networks, social network, etc… and therefore enjoy significant demand economies of scale (network effect).

A freemium model is particularly suitable when the marginal cost of producing extra units is low. A freemium business model can be coupled with a multi-sided platform model, where revenues are captured from one type of affiliated customers only (e.g. advertisers). Likewise, a freemium business model can be associated with tiered services, where some extra features, capacity, services (e.g. support, training, configuration) are chargeable.

For instance, most cloud service providers – ranging from Infrastructure providers (IaaS), platform providers (PaaS) to software service providers (SaaS) – use freemium pattern in their business models.

Other examples include free-to-play games where games can be downloaded for free. Revenues are generated by in-game items that can be purchased by players to enhance game-play and/or aesthetics. For instance Thinkgaming.com estimates that in Nov 2016 the total revenue generated by Pokemon Go is nearly USD 5million, of which 10% from advertising and 90% from In-Application Purchases. In Jul 2018, Sensor Tower estimates total revenue for Pokemon Go has surpassed $1.8 billion

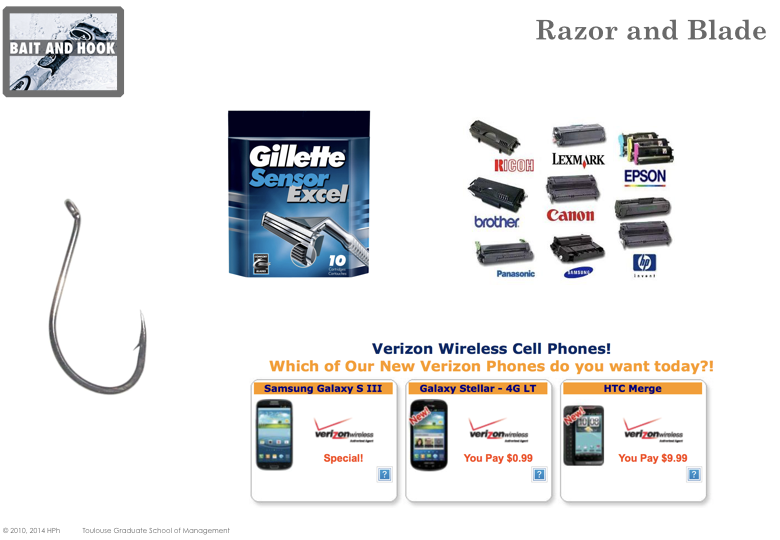

Bait & Hook

The Bait and Hook (aka Razor and Blade) business model was first introduced by Gillette: products (the razor in the case of Gillette) are sold at rather low price but require refills, consumables or additional products (the hook) that are sold at higher prices.

The model has been extensively used by companies who want to derive pro- fit from recurring purchases. For instance, Nespresso subsidizes the purchase of Nespresso machines but sell Nespresso capsules. Telecom operators may provide cell phones for free or nearly for free in exchange for a data plan over several months.

Open innovation

Open innovation has been extensively studied by H. Chesbrough ( [Chesbrough03] [Chesbrough06] ) . In his own words

”Open innovation is a paradigm that assumes that firms can and should use external ideas as well as internal ideas, and internal and external paths to market, as the firms look to advance their technology ”.

The main difference between closed and open innovation is that the later hinges upon widely distributed knowledge while the former rely on internal resources only. With the open innovation paradigm, a company can buy or operate inventions from third parties and likewise license or sell some of its own innovations. According to this model, knowledge and intellectual innovation is no longer concentrated in a few very large organizations. Smaller institutions or even individuals can find outlets for their work as companies look for ideas outside their boundaries.

With crown sourcing, (e.g. crown design) the model goes even beyond outsourcing innovation, in the sense that is creates a full eco-system where competing/collaborating organizations or people are bringing their insights and ideas.

Networks are often good for solving design and research problems because they can bring experts coming from different fields (including from outside of the firm’s industry). It is however important to define an adequate set of incentives to ensure that users from outside participate and that in-house experts don’t systematically get preference over experts from the crowd.

Disruptive Innovation

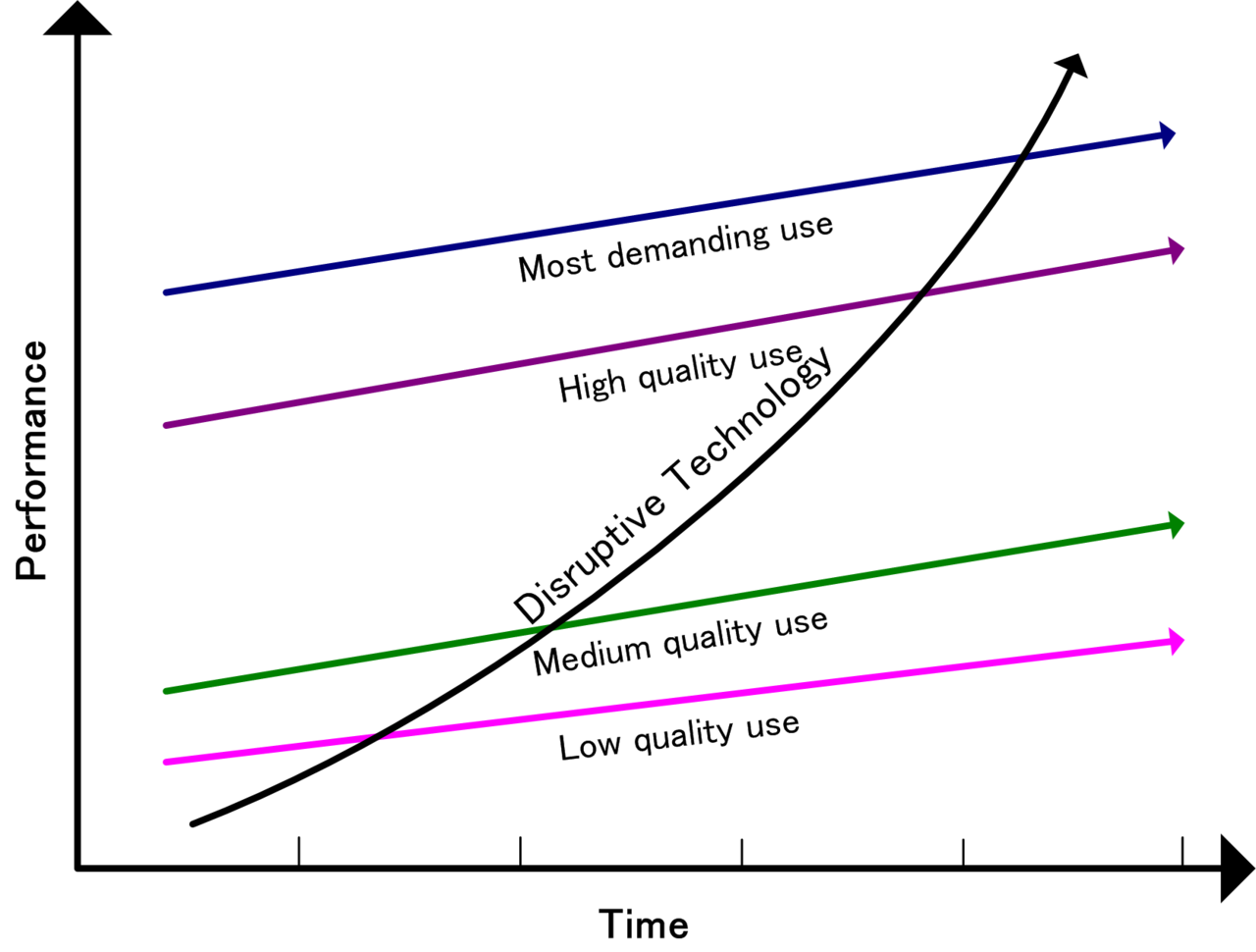

The term disruptive innovation was coined by Clayton Christensen who provided an explanation for the failure of well-respected companies and the appearance of new value propositions / players ( [Christensen97] [Christensen00] [Christensen03] [Christensen04] )

„few academic management theories have had as much influence in the business world as Clayton M. Christensen’s theory of disruptive innovation.” ( [King15] )

Christensen notes that when a company tries to satisfy its existing customer base, it usually focuses on improving its current product/service offering and will typically add more features or increase performance. More often than not, the value proposition will overshoot customers’ expectation and soon become

„ too sophisticated, too expensive, and too complicated for many customers in their market” [claytonchristensen.com]

Christensen stresses that companies pursue product/service improvement at the higher tiers of their markets because this is what has historically helped them succeed:

„by charging the highest prices to their most demanding and sophisticated customers at the top of the market, companies will achieve the greatest profitability” (Christensen).

This however paves the way to disruptive innovations: a newer technology making its appearance in the background, serving primary needs in a better / more convenient way and allowing consumers at the bottom of a market access to a product or service that was historically only accessible to consumers with a lot of money or a lot of skill.

„Characteristics of disruptive businesses, at least in their initial stages, can include : lower gross margins, smaller target markets, and simpler products and services that may not appear as attractive as existing solutions when compared against traditional performance metrics. Because these lower tiers of the market offer lower gross margins, they are unattractive to other firms moving upward in the market, creating space at the bottom of the market for new disruptive competitors to emerge.” (Christensen)

In many industries, technologies improve faster than customer demands of those technologies increase. „The overlooked, underserved and seemingly unprofitable end of the market [CPU for personal computer less than $1000 in 1998] can provide fertile ground for massive competitive change.” (Andy Groove, former CEO of Intel) Time after time and industry after industry, „once the disruptive product gains a foothold in new or low-end markets, the disruptors are on a path that will ultimately crush the incumbents” ([Christensen, 2003]).

In a nutshell

- A disruptive innovation initially offers a lower performance according to what the mainstream market historically demanded,

- The new product/service is more convenient can serve a new demand

- As it improves along the traditional performance attributes, it eventually displaces the incumbent technology

Disruptive innovations are all the more effective if they can create a negative experience effect and penalize the dominant companies operating according to the business model in force. Leaders will suddenly be at a competitive disadvantage because of the very practices that have been successful in the past. The reaction therefore requires a twofold effort : learning the new rules of the game and dis-learning traditional practices ([Grandval and Ronteau, 2011]).

„not all innovations are disruptive, even if they are revolutionary. For example, the first automobiles in the late 19th century were not a disruptive innovation, because early automobiles were expensive luxury items that did not disrupt the market for horse-drawn vehicles. The market for transportation essentially remained intact until the debut of the lower-priced Ford Model T in 1908. The mass-produced automobile was a disruptive innovation, because it changed the transportation market, whereas the first thirty years of automobiles did not” (wikipedia).

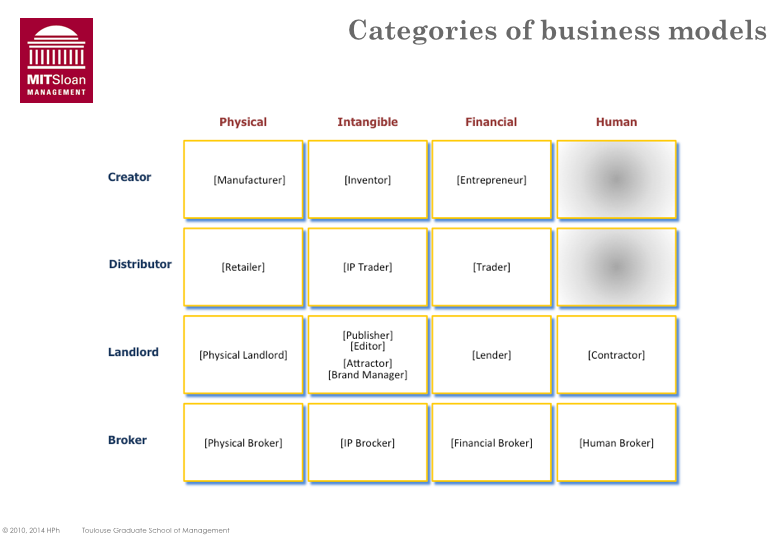

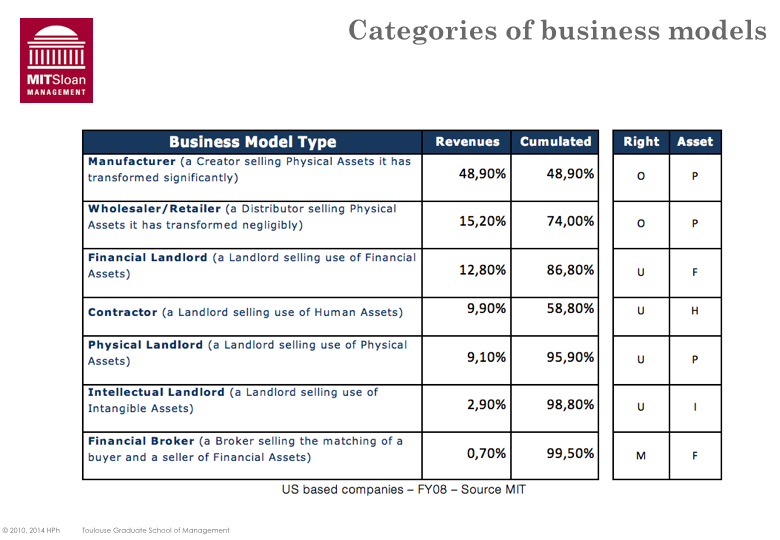

Business Model Typology

Considering the number of parameters that can influence a business, there are countless ways of clustering and depicting business models. However, the typology proposed ( [Malone06] ) is in many ways, illuminating as it first considers what asset rights are being sold by a firm, and then looks at what kind of assets are involved.

The following is a free adaptation of the framework original description.

Type of right sold

The heart of any business is what it sells and offers to its customers. One of the most significant characteristic is the kind of legal right that is conferred to the buyer upon the completion of the transaction.

Right of ownership - Buyers acquire the continuing right to use an asset (the ownership title is transferred to the customer) in any way, including selling, destroying, or disposing of it. It is usually useful to distinguish between firms that build what they sell (e.g. manufacturers) from those that sell what other firms have made (e.g. retailers).

Right to use - Customers buy the right to use assets (e.g. rented car, hotel room, phone subscription, pay-tv) in a certain way for a given period of time, while the ownerships of the asset is not transferred.

Right to Match - is the right to be matched with potential buyers or sellers of something. For instance a real estate broker first secures the right to buy, sell or lease a property on behalf of the principal and then can sell this right to a counter-party.

Categories of Firms

Based on the type of right criterion, there are mainly four categories of firms. Obviously a firm may offer various value propositions based on different business models. In the remaining we assume a single, unbundled offer.

Creator - designs a product, buys raw materials and inputs from upstream suppliers, then transforms or assembles – a creator can outsource the manufacturing of its product – them to create a ’product’ sold to buyers.

Distributor - buys a product and resells essentially the same product to somebody else. The distributor may offer additional services like repackaging or transporting the product.

Landlord - sells the right to use (i.e. to make temporally use of an asset) but not to own.

Broker - facilitates sales by matching potential buyers and sellers. Unlike a distributor, a broker doesn’t take ownership of the product being sold. A Broker can receive a fee from the buyer, the seller or both.

Types of assets

A business model is also characterized by the type of assets for which rights are being sold.

Physical any durable items (building, computer, and machine tools) as well as nondurable items (food, clothing, paper),

Intangible legally protected intellectual property (patents, copyrights, trademarks, etc..) as well as other intangible assets like knowledge, goodwill, brand,

Financial cash and other assets like stocks, bonds, insurance policies that give their owners rights to potential future cash flows,

Human people time and effort

Combination

In theory, each of the types of right can be associated with each of the types of assets which yields sixteen different business models. The list of business models and associated definitions are verbatim from [Malone et al., 2006].

Manufacturer creates and sells physical assets. Manufacturer is the predominant type of Creator. Examples: Airbus, General Motors.

Inventor creates and then sells intangible assets such as patents and copyrights. Firms using this business model exclusively are relatively rare, but some technology firms generate part of their revenues this way. Firms that license the use of their intangible assets while still retaining ownership are not classified as Inventors; they are Intellectual Landlords (see below).

Entrepreneur creates and sells financial assets often creating and selling firms. We do not include in this business model entrepreneurs who never sell the firms they create.

Human Creator creates and sells human assets. Malone stressed that since selling human –whether they were created naturally or artificially or obtained by capture– is illegal and morally repugnant in most places today, this business model is included here for logical completeness and as a historical footnote about a form of business model that was more common in the past. However, the new development in AI and robotics may relaunch this business model by creating and selling robots.

Wholesaler/Retailer buys and sells physical assets. This is the most common type of Distributor. Examples : Wal*Mart, Amazon.

Intellectual Property Trader buys and sells intangible assets. This business model includes firms that buy and sell intellectual property such as copyrights, patents, domain names, etc.

Financial Trader buys and sells financial assets without significantly transforming (or designing) them. Banks, investment firms, and other fi- nancial institutions that invest for their own account are included in this business model.

Human Distributor buys and sells human assets. Like Human Creators, this business model is illegal and rare in most places and is included here only for logical completeness.

Physical Landlord sells the right to use a physical asset. The asset may, for example, be a location (such as an amusement park) or equipment (such as construction equipment). Depending on the kind of asset, the payments by customers may be called ’rent’, ’lease’, ’admission’, or other similar terms. This business model is common in industries like real estate rental and leasing, accommodation, airlines and recreation.

Intellectual Landlord licenses or otherwise gets paid for limited use of intangible assets. There are three major subtypes of Intellectual Landlord i) a publisher provides limited use of information assets such as software, newspapers, or databases in return for a purchase price or other fee (often called a subscription or license fee), ii) a Brand Manager gets paid for the use of a trademark, know-how, or other elements of a brand. This includes franchise fees for businesses such as restaurant or hotel chains and iii) an Attractor attracts people ?s attention using, for example, television programs or web content and then ?sells ? that attention (an intangible as- set) to advertisers. The Attractor may devote significant effort to creating or distributing the assets that attract attention, but the source of revenue is from the advertisers who pay to deliver a message to the audience that is attracted. This business model is common in radio and television broad- casting, some forms of publishing, and some Internet-based businesses. Example : New York Times, Google.

Financial Landlord lets others use cash (or other financial assets) under certain (often time-limited) conditions. There are two major subtypes i) Lenders provide cash that their customers can use for a limited time in return for a fee (usually called ’interest’) and ii) Insurers provide their customers financial reserves that the customers can use only if they experience losses. The fee for this service is usually called a ’premium’.

Contractor sells a service provided primarily by people, such as consulting, construction, education, personal care, package delivery, live entertainment or healthcare. Payment is fee for service, often (but not always) based on the amount of time the service requires. In most cases, Contractors also require physical assets (such as tools and workspace), and Physical Landlords also provide human services (such as cleaning hotel rooms and staffing amusement parts) associated with their physical assets. In cases where substantial (more than 50% in value) amounts of both human and physical assets are used to provide a service, we classify a firm’s business model (as Contractor or Physical Landlord) on the basis of which kind of asset is ’essential’ to the nature of the service being provided.

Financial broker matches buyers and sellers of financial assets. This includes insurance Brokers and stock Brokerage functions in many large financial firms.

Physical broker matches buyers and sellers of physical assets. Examples: eBay, Century 21.

Intellectual property (IP) broker matches buyers and sellers of intangible assets.

Human Resources (HR) broker matches buyers and sellers of human services. Examples: interim agencies